Progressive Auto Insurance Review for 2024 (Rates, Discounts, & Coverage Options)

With prices starting at $35 per month, Progressive auto insurance reviews say quotes are generally low. Progressive is an excellent option for drivers who want a modern insurance experience and discount opportunities, but it might not be right if you want a lot of policy customization options.

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Dec 23, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

Progressive

Average Monthly Rate For Good Drivers

$35A.M. Best Rating:

A+Complaint Level:

LowPros

- Affordable rates for most drivers

- Digital policy management

- Snapshot discount for safe drivers

Cons

- Low customer loyalty ratings

- Rates can be high for teens

With rates as low as $35 per month, Progressive auto insurance reviews recommend Progressive to drivers on a budget looking for a great digital experience.

Progressive is one of the best-known auto insurance companies in America, and for good reason. Aside from affordable rates, Progressive also offers valuable policy add-ons and excellent digital management tools.

Progressive Car Insurance Rating| Rating Criteria | |

|---|---|

| Overall Score | 4.4 |

| Business Reviews | 4.0 |

| Claim Processing | 3.5 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.2 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.3 |

| Plan Personalization | 4.5 |

| Policy Options | 5.0 |

| Savings Potential | 4.5 |

Find everything you need to know about Progressive in our review below. Then, enter your ZIP code into our free comparison tool to compare Progressive rates with other companies in your area.

- Progressive auto insurance rates are usually affordable

- Drivers looking for a digital insurance experience should consider Progressive

- While high-risk drivers can find low rates with Progressive, teens might not

Progressive Auto Insurance: Average Monthly Rates

Whether you need car insurance for the first time or want to switch policies to lower your monthly costs, researching your options is one of the most crucial steps in finding low prices. Progressive may be one of the most famous names in car insurance, but you should still do your research before signing up.

Generally speaking, Progressive is an affordable option for car insurance. In fact, Progressive auto insurance rates are famous for being some of the lowest available.

To see how low your rates might be, check the average Progressive auto insurance quotes below.

Progressive Auto Insurance Monthly Rates by Coverage Level, Age, & Gender| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $308 | $801 |

| Age: 16 Male | $327 | $814 |

| Age: 18 Female | $251 | $591 |

| Age: 18 Male | $281 | $662 |

| Age: 25 Female | $52 | $141 |

| Age: 25 Male | $54 | $146 |

| Age: 30 Female | $48 | $131 |

| Age: 30 Male | $50 | $136 |

| Age: 45 Female | $41 | $112 |

| Age: 45 Male | $39 | $105 |

| Age: 60 Female | $35 | $92 |

| Age: 60 Male | $36 | $95 |

| Age: 65 Female | $41 | $109 |

| Age: 65 Male | $38 | $103 |

As you can see, Progressive auto insurance costs are generally low. However, you may pay more depending on a variety of factors, like your vehicle, marital status, and credit score. Although Progressive is usually an affordable option, you should still compare rates with other companies to ensure you’re getting a good deal.

To compare average auto insurance rates by age and gender with other companies, you’ll need a personalized Progressive quote. Getting a quote is easy – simply fill out the request form on the Progressive site to get started.

Once you have your Progressive insurance quote, your next step is to get quotes from as many companies as possible. If you don’t want to fill out multiple quote request forms, you can use our free quote generator by entering your ZIP code.

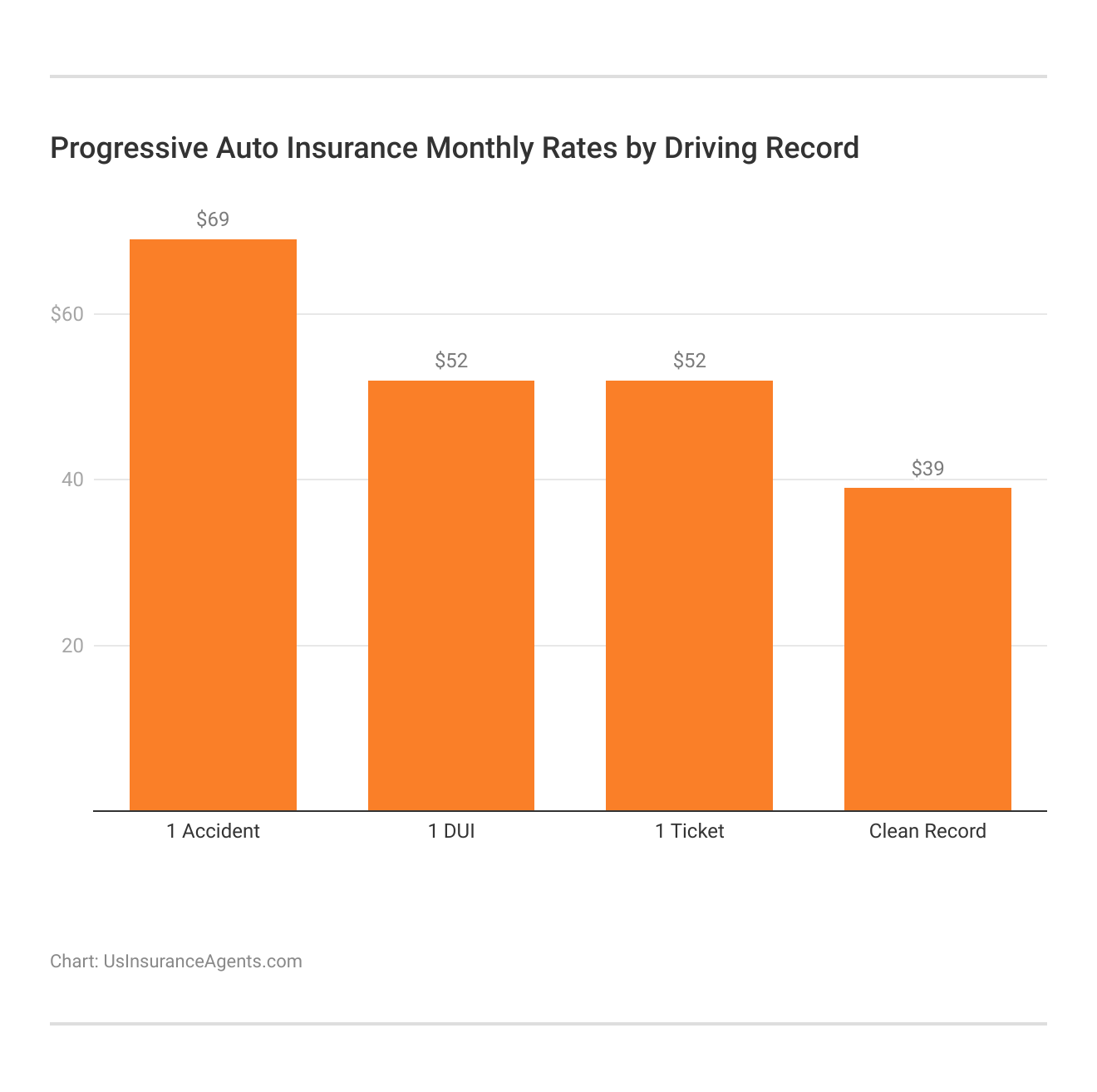

Progressive Auto Insurance Rates by Driving Record

One of the most influential factors impacting your car insurance rates is your driving record. Drivers with traffic incidents and accidents can pay double or more for insurance compared to drivers with clean records.

Check below to see how Progressive car insurance costs vary by driving record.

Progressive is one of the most affordable car insurance companies on the market, and that includes rates for drivers with imperfect driving records. If you do have marks on your driving record, avoiding new incidents will help your rates lower in the future.

Progressive Car Insurance Rates by Credit Score

In most states, car insurance companies are allowed to use your credit score when determining your rates. Statistically, drivers with higher credit scores get into fewer accidents and file fewer claims.

Brad Larson Licensed Insurance Agent

Take a look below to see average Progressive car insurance quotes by credit score.

Progressive Auto Insurance Rates by Credit Score| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $168 | $180 | $260 | |

| $102 | $108 | $161 | |

| $140 | $157 | $201 | |

| $100 | $118 | $146 | |

| $148 | $171 | $209 |

| $128 | $145 | $184 |

| $145 | $152 | $176 | |

| $83 | $100 | $125 |

As you can see, Progressive offers relatively affordable rates no matter what your score is. However, you can lower your rates by improving your credit score.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Compare Progressive Auto Insurance Rates to Top Providers

Progressive is one of the best auto insurance companies that sell policies online, but that doesn’t mean it’s your only choice. Compare Progressive insurance rates with other top providers below.

Progressive Auto Insurance Rates Compared With Top Competitors| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $53 | $139 | |

| $30 | $80 | |

| $68 | $174 |

| $44 | $115 |

| $33 | $86 | |

| $37 | $99 |

Progressive quotes are usually an affordable option for most drivers, as you can see from the rates above. However, it’s still a good idea to compare policies, especially if you want more than minimum insurance – Progressive may not offer everything you want in a policy.

When looking at two or more insurance companies, there are more things to compare than rates. For example, you should have an idea of how well a company’s claim process works, in case you need to file one in the future.

Luckily for Progressive customers, Progressive generally does well with its claims process. That’s especially true when you compare Progressive to companies that have less-than-stellar claims ratings, like Allstate or State Farm.

Progressive Auto Insurance Options

When it comes to policy customization, you have a variety of Progressive car insurance options to choose from.

Progressive sells the basic types of car insurance you can find at most providers. That includes everything you need to meet the minimum requirement in your state or a full coverage auto insurance policy.

For drivers looking to customize their policy even more, Progressive offers a variety of add-ons. These include:

- Custom Parts and Equipment Coverage: Your standard policy won’t pay for customizations you’ve made to your car, like stereos and navigation systems. Progressive offers custom parts and equipment coverage to cover customizations.

- Gap Insurance: If you total your car while you owe more on a loan than the vehicle is worth, you’ll be stuck paying for a car you don’t drive. The best gap insurance coverage pays the difference on an upside-down loan.

- Rental Car Reimbursement: If your car is stuck in the shop after a covered accident, this add-on covers the cost of a rental vehicle.

- Rideshare: Progressive offers some of the best auto insurance for rideshare drivers with this affordable add-on.

- Roadside Assistance: Progressive comes to the rescue when you’re stranded with emergencies like flat tires, dead batteries, or empty gas tanks.

Although the company sells insurance in all 50 states, Progressive car insurance reviews suggest checking with a representative to make sure your desired add-ons are available in your area.

Progressive Auto Insurance Discounts

One of the best ways to get low-cost car insurance is with discounts. To help you save, there are 13 Progressive car insurance discounts you may qualify for.

Heidi Mertlich Licensed Insurance Agent

Check below to see how many Progressive auto insurance discounts you might qualify for.

Most discounts will apply directly to your policy, but some require more work. For example, you won’t earn a loyalty discount until after you’ve been a Progressive customer for at least a year.

Others, like the good student discount, require that you turn in proof of your grades. You may have to turn in proof every time your policy renews, which is a six-month period.

Snapshot by Progressive

Most insurance companies offer telematics or usage-based insurance (UBI) programs to help safe drivers earn additional savings, and Progressive is no different.

Progressive’s UBI program is called Snapshot. Snapshot can help you save up to 30% on your insurance by allowing Progressive to track your driving behaviors.

However, not everyone is a fan of Snapshot. Before you sign up for Snapshot, consider this Reddit user’s experience.

My Experience with Progressive Insurance’s Snapshot Device – A Warning

byu/jkasephoto inInsurance

As this Reddit user’s experience suggests, Snapshot is one of the few UBI programs that will raise your rates if you don’t drive well enough. If you are a high-mileage driver, frequently speed or slam on your brakes, or drive late at night, Snapshot might not be the best choice.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Progressive Auto Insurance Customer Reviews

Progressive generally gets positive reviews, especially from families who need auto insurance for new drivers. Progressive car insurance reviews and consumer reports typically praise the company’s low rates, digital tools, and community efforts.

Every year we drive veterans’ lives forward by gifting vehicles to them, their families, their businesses, and the non-profits that support them through our Keys to Progress program. Learn more at https://t.co/Sfl1dPCtqs #KeysToProgress #GivingBack #Veterans #KTP2024 pic.twitter.com/e57zNsCFH3

— Progressive (@progressive) November 21, 2024

However, not everyone is happy. Progressive struggles with its customer loyalty ratings, with many drivers citing concerns about pricing as a chief reason for leaving. While all insurance companies periodically raise rates in some areas, many Progressive policyholders complain about unfair price hikes.

Still, Progressive sets itself apart from the competition with its excellent digital options. Progressive recognizes that many drivers want a more modernized insurance experience instead of the slower traditional methods, and has focused on the Progressive website and mobile app.

Progressive Auto Insurance Business Reviews

Reading customer reviews is vital to determining if a company is a good fit, but you can also look at third-party ratings. These ratings are based on things like financial strength and customer satisfaction.

Check below to see how Progressive fares with third-party rating companies.

Progressive Insurance Business Ratings & Consumer Reviews| Agency | |

|---|---|

| Score: 832 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 72/100 Avg. Customer Feedback |

|

| Score: 1.11 Avg. Complaints |

|

| Score: A+ Superior Financial Strength |

From how long it typically takes Progressive to process an auto insurance claim to the overall financial strength of the company, most third-party rating companies agree that Progressive is a good choice.

Progressive Auto Insurance Pros and Cons

All insurance companies have their strengths and weaknesses, and that’s true for Progressive. When you shop at Progressive, you’ll gain access to the following benefits:

- Low Rates: Progressive is generally one of the cheapest car insurance companies on the market. Progressive rates are so low that it offers some of the best auto insurance for high-risk drivers.

- Digital Insurance Tools: Progressive makes it easy to manage your policy online or through its app, meaning you won’t need to speak to a representative unless you want to.

- Generous Discounts: Between Snapshot and Progressive’s other discounts, there are plenty of ways to save.

Before signing up for a policy, Progressive insurance reviews typically say you should be aware of these disadvantages:

- Unexpected Price Hikes: Many Progressive complaints focus on the fact that the company increases premiums for no clear reason.

- Low Customer Loyalty: Progressive auto insurance costs may be low, but the company struggles to retain customers.

These pros and cons are a great way to get a quick idea of whether Progressive is a good fit for you. However, you should compare Progressive with other insurance companies before making your decision.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

See if Progressive Car Insurance is Right for You Today

As one of the most famous insurance companies on the market, Progressive is well-known for being an affordable coverage option. That’s especially true for younger drivers and people with less-than-perfect driving records. However, you can save money by comparing online car insurance quotes no matter what type of driver you are.

Although Progressive is usually cheap, you should always compare car insurance quotes to ensure you get a fair price. To see how Progressive auto insurance rates compare with other companies in your area, enter your ZIP code into our free comparison tool today.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Progressive a good auto insurance company?

Yes, Progressive is considered a good auto insurance company due to its competitive rates, a wide range of coverage options, and innovative tools like Snapshot.

How much is Progressive auto insurance?

Minimum Progressive insurance rates start at $35 per month, but many factors affect how insurance companies calculate your rates. To ensure you get the best rates, make sure to compare prices with as many companies as possible.

Are people happy with Progressive?

Many customers are satisfied with Progressive’s pricing and online tools, though some reviews cite mixed experiences with claims handling.

Does Progressive raise rates after six months?

Progressive may raise rates after six months if your risk factors change or if you’re on a six-month policy that undergoes reevaluation. If Progressive raises your rates in a way you feel is unfair, you can enter your ZIP code into our free comparison tool to check rates at other companies.

Who is cheaper, Geico or Progressive?

Geico tends to be slightly cheaper on average, but Progressive may offer better rates depending on discounts and driving habits. To see how Geico might fit your needs, check out our Geico auto insurance review.

Is Progressive good at paying claims?

Progressive generally has a solid reputation for paying claims, though some customers report delays or communication issues during the process. If, for any reason, you need to learn how to file an appeal for a Progressive car insurance claim, a customer service representative can help.

What is Snapshot?

Snapshot is Progressive’s usage-based program that monitors driving habits to potentially lower your rates based on safe driving behavior.

Does Snapshot raise rates?

Snapshot can raise rates if it determines you have risky driving habits, such as hard braking or driving at high speeds. If you feel your rates were raised unfairly, contact a representative by calling the Progressive car insurance phone number.

Does Progressive sell gap insurance?

Progressive offers some of the best gap insurance coverage to help cover the difference between your car’s value and what you owe on a loan if your car is totaled.

Does Progressive cover glass?

Yes, Progressive offers glass coverage through its comprehensive insurance, which can help pay for windshield and window repairs or replacements.

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.