Allstate vs. State Farm Car Insurance in 2024 (Side-by-Side Comparison)

Our review of Allstate vs. State Farm car insurance found that State Farm offers the most economical options, but Allstate offers more coverage and has a better financial strength rating. State Farm's minimum rates start at $30/mo, while Allstate's minimum rates start at $60/mo.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

Our comparison of Allstate vs. State Farm car insurance found that while State Farm is the cheaper company, Allstate has more coverage options.

Both State Farm and Allstate are solid choices for auto insurance coverage, but which is the better fit depends on what you are looking for in a company. We break down every aspect of State Farm and Allstate, from customer reviews to discount options, to help you make that choice.

Allstate vs. State Farm Car Insurance Insurance Rating| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.8 | 4.3 |

| Business Reviews | 4.0 | 5.0 |

| Claim Processing | 3.0 | 4.3 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.4 | 4.2 |

| Customer Satisfaction | 4.0 | 4.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.2 | 3.9 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 3.8 |

| Savings Potential | 3.8 | 4.3 |

| Allstate Review | State Farm Review |

Don’t wait to get coverage and protect your vehicles. Find affordable auto insurance in your area today by entering your ZIP in our free tool.

- State Farm’s car insurance rates are cheaper than Allstate’s

- Allstate has better business ratings than State Farm

- Both companies offer full coverage options for customers

Allstate vs. State Farm Car Insurance Rate Comparison

Premiums can be a deciding factor for many potential customers when choosing a car insurance provider, which is why we are diving into State Farm and Allstate’s rates.

After all, finding a cost-efficient auto insurance premium that fits into one’s overall cost of living is essential.

Kristen Gryglik Licensed Insurance Agent

For example, male drivers often pay more due to statistics showing them as being more prone to risky behavior behind the wheel (Read More: Best Car Insurance for High-Risk Drivers). Married drivers who are 60 years and older, however, enjoy the cheapest car insurance premiums available based on age, gender, and marital status.

Allstate vs. State Farm Minimum Coverage Auto Insurance Monthly Rates by Age & Gender| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $237 | $124 |

| Age: 16 Male | $260 | $146 |

| Age: 30 Female | $64 | $36 |

| Age: 30 Male | $67 | $39 |

| Age: 45 Female | $62 | $33 |

| Age: 45 Male | $61 | $33 |

| Age: 60 Female | $59 | $30 |

| Age: 60 Male | $60 | $30 |

Regarding Allstate vs. State Farm teen auto insurance rates, a 16-year-old female driver pays $237 per month with Allstate, while a male driver of the same age pays $260. Similarly, a 16-year-old female pays around $124 monthly for coverage with State Farm, while a 16-year-old male pays $146 per month.

You’ll notice that car insurance rates decrease drastically once drivers enter their 20s — especially if their driving records are accident-free.

A 30-year-old female driver, for example, pays $64 on average per month for car insurance with Allstate and just $36 per month with State Farm. In addition to age and gender, driving records will impact State Farm and Allstate auto insurance rates.

Allstate vs. State Farm Minimum Coverage Auto Insurance Monthly Rates by Driving Record| Driving Record | ||

|---|---|---|

| Clean Record | $61 | $33 |

| Not-At-Fault Accident | $87 | $40 |

| Speeding Ticket | $72 | $37 |

| DUI/DWI | $106 | $45 |

State Farm has cheaper premiums than Allstate’s averages overall, even for drivers with poor driving records. So, if you’re looking for a solid deal on car insurance, State Farm might be your saving grace.

Remember, whether it’s Allstate vs. State Farm car insurance rates or another company comparison, car insurance costs are never a one-size-fits-all deal.

Depending on where you live, rates can vary significantly. Luckily, both State Farm and Allstate are available in all 50 U.S. states, making them excellent options for many drivers.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Allstate vs. State Farm Car Insurance Coverage Options

When considering Allstate vs. State Farm auto insurance coverage options, both companies offer liability, comprehensive, and collision coverage.

They also offer additional requirements, like uninsured and underinsured motorist coverage, personal injury protection, and medical payments coverage.

Allstate vs. State Farm Car Insurance Coverage Options| Coverage Type | ||

|---|---|---|

| Accident Forgiveness | ✅ | ✅ |

| Collision Coverage | ✅ | ✅ |

| Comprehensive Coverage | ✅ | ✅ |

| Gap Insurance | ✅ | X |

| Liability Coverage | ✅ | ✅ |

| Medical Payments (MedPay) | ✅ | ✅ |

| New Car Replacement | ✅ | X |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Rental Reimbursement | ✅ | ✅ |

| Rideshare Coverage | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Uninsured/Underinsured Motorist Coverage | ✅ | ✅ |

State Farm and Allstate also offer emergency roadside assistance and rideshare driver coverage. Emergency roadside assistance can help you out if you run out of gas or have a flat tire, and both companies offer specialized insurance options for motorists who are part of a transportation network company.

Read More: How do I know if I chose the right coverages?

State Farm also offers rental reimbursement coverage to pay for car rental fees when your car is being repaired, and they will also cover travel expenses if your car breaks down at least 50 miles away from your home.

Both companies offer rideshare insurance. Allstate’s rideshare coverage program is called Allstate Ride for Hire®, and State Farm offers rideshare insurance coverage to lower deductibles for TNC drivers. Unfortunately, this coverage isn’t available in all states, so it’s important to check with a car insurance agent to see if it’s available where you live.

While State Farm and Allstate share many coverage options, there are some differences between the two companies, with State Farm offering fewer coverage options than Allstate. So it would help if you determined the types of coverage you want before deciding on one or the other.

Allstate vs. State Farm Car Insurance Discount Options

Both Allstate and State offer saving options for customers. See how the two companies’s discounts compare.

Allstate vs. State Farm Car Insurance Discounts| Discounts | ||

|---|---|---|

| Anti-Lock Brakes | 5% | 5% |

| Anti-Theft | 10% | 15% |

| Claim Free | 20% | 20% |

| Continuous Coverage | 15% | 10% |

| Daytime Running Lights | 3% | X |

| Defensive Driver | 10% | 5% |

| Distant Student | 5% | 7% |

| Driver's Ed | 8% | 15% |

| Driving Device/App | 20% | 30% |

| Early Signing | 10% | 5% |

State Farm and Allstate both offer usage-based insurance options, which can help lower your premium if you’re a safe driver.

If you join Allstate’s usage-based driver program, be aware that poor driving can raise your rates rather than lower them. However, with both companies, you can save by also buying home or renters insurance.

Just make sure to read State Farm vs. Allstate homeowners insurance or Allstate vs. State Farm renters insurance reviews to see which has better home or renters insurance for you. For example, you can read reviews of Allstate vs State Farm homeowners insurance on Reddit.

Allstate vs. State Farm Car Insurance Customer Reviews

Customer reviews on places like Reddit show how happy customers are with how representatives treat them and how well their insurance needs are met—both of which are key to being happy with your provider. Take a look at an example of State Farm vs Allstate on Reddit below.

Allstate vs State Farm – Is one really better or just price for decision?

byu/stuman1974 inInsurance

For mobile app ratings from customers, State Farm’s finance mobile app has over 22,000 reviews on the Google Play Store, and most users gave it a five-star rating.

Meanwhile, Allstate Insurance Company’s app has over 42,000 reviews on the Google Play Store for their mobile app, and they have a slightly lower rating of four stars. However, it’s worth noting that more customers have reviewed Allstate’s mobile app than State Farm’s.

While you compare Allstate vs. State Farm’s mobile app, keep in mind that ratings are influenced by factors like usability and the ease of making a claim or payment. Additionally, ratings can change over time depending on the number of customers who respond (Learn More: Can You Get in Trouble for Leaving an Online Review?).

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Allstate vs. State Farm Car Insurance Business Reviews

Finding the right car insurance provider is extremely important, and it’s normal to seek reassurance before making that final call. State Farm Insurance and Allstate each earn millions annually from new policies and pay millions in filed claims.

Brandon Frady Licensed Insurance Producer

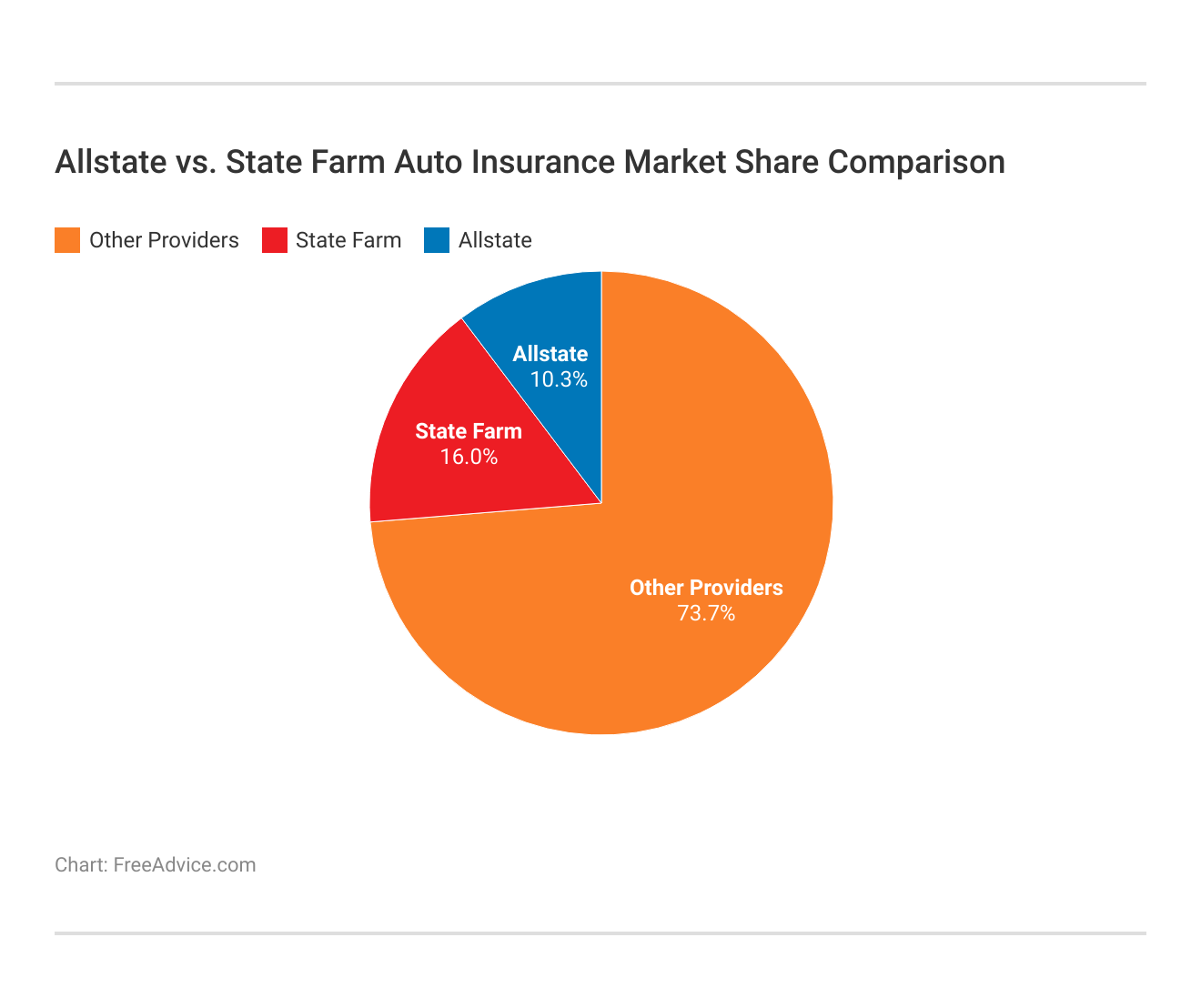

Take a look at Allstate and State Farm’s market shares below, where you can see that Allstate’s market share is nearly half that of State Farm Mutual Automobile Insurance Company.

State Farm is the clear leader when you look at both companies’ market shares. State Farm serves many more customers than Allstate based on market share.

However, there are more ratings to consider beyond just market share for Allstate and State Farm, such as financial and satisfaction ratings.

Take a look below to see which insurance company has the most complaints, which has better financial ratings, and more.

Insurance Business Ratings & Consumer Reviews: Allstate vs. State Farm| Agency | ||

|---|---|---|

| Score: 832 / 1,000 Avg. Satisfaction | Score: 877 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: C- Below Avg. Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 75/100 Positive Customer Feedback |

|

| Score: 1.45 More Complaints Than Avg. | Score: 0.78 More Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: B Fair Financial Strength |

As you can see, both Allstate and State Farm have strong ratings for customer satisfaction, but State Farm Indemnity Company scored lower for business practices and financial strength (Read More: Allstate Auto Insurance Review).

It’s important to note that no company can please everyone. Both Allstate and State Farm auto insurance reviews are generally positive, which is why they continue to be profitable and attract new customers each year.

Allstate Car Insurance Pros and Cons

Allstate has some attractive features that set it apart from other companies, such as:

- Accident Forgiveness: Allstate offers accident forgiveness to good drivers when they enroll, whereas State Farm requires a policyholder to be with them for nine years before becoming eligible for accident forgiveness.

- Add-Ons: Allstate offers a few more add-ons for full coverage auto insurance policies than State Farm, such as sound system insurance, which covers the cost of stolen or damaged audio or video equipment in your car.

- Financial Strength: Allstate has better ratings than State Farm for financial strength and business practices.

Allstate definitely has more add-ons than State Farm, with accident forgiveness being one of its big draws.

Of course, Allstate has some cons that may make customers go with State Farm or another company instead. These drawbacks include:

- Higher Rate Averages: State Farm is cheaper than Allstate for auto insurance coverage.

- UBI Rate Increases: Participating in Allstate’s good driver program could result in a rate hike for poor performances.

Allstate’s main con is that it’s a more expensive company for customers. However, your average rates may be cheaper when you get an Allstate quote if you have a clean driving record and live in an affordable area.

It’s important to compare quotes from companies in your area to see which offers the best rates for you based on your unique set of circumstances.

State Farm Car Insurance Pros and Cons

State Farm is a popular company for several reasons, but some of the biggest pros that make it stand out include:

- Cheap Rates: State Farm is more affordable than several companies, including Allstate.

- Local Agents: State Farm has more local agents available for assistance than Allstate, as well as a larger market share.

- Good Driver Discount: State Farm doesn’t raise rates for drivers participating in its UBI program, making it easier to get low-cost car insurance with driver discounts.

If you choose State Farm as a provider, there are also some cons. The main cons of State Farm are as follows.

- Financial Strength: State Farm’s financial strength and business practice ratings are lower than Allstate’s ratings.

- Add-On Coverages: State Farm offers fewer options than Allstate for add-ons.

Fully considering the cons and pros of both State Farm and Allstate will help you choose the best option for you.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Choosing Between Allstate and State Farm Car Insurance

State Farm is the better option for drivers looking for affordability, with cheaper rates on average than Allstate. However, shoppers looking for specialty add-on coverages will find more options available at Allstate than at State Farm. So, if you are looking for the best new car replacement or the best gap insurance coverage, Allstate may be a better fit.

Shopping for the best car insurance provider in your area doesn’t need to be difficult. Compare quotes with our free tool to find the best deal.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Allstate more expensive than State Farm?

Yes, Allstate is more expensive than State Farm. Allstate car insurance rates start at $59/mo, whereas State Farm car insurance rates start at $30/mo.

What’s cheaper than Allstate?

State Farm is cheaper than Allstate.

Who normally has the cheapest car insurance?

United Services Automobile Association (USAA) usually has the cheapest car insurance, but it is only sold to military members.

Is Allstate car insurance overpriced?

Allstate car insurance is pricier than at other companies, but Allstate Insurance does offer more specialty coverage. Shop for affordable auto insurance today with our free quote tool.

Where does State Farm rank in insurance companies?

When it comes to comparing companies like Allstate vs. State Farm vs. Progressive, State Farm is the largest company by market share. However, it’s finacial ratings are lower when you compare State Farm vs. Progressive and Allstate.

What is the #1 auto insurance in the US?

State Farm Insurance is the #1 company by market share.

Who is State Farm owned by?

State Farm Insurance is not owned by a parent company.

Who owns Allstate insurance?

There is no parent company that owns Allstate Corporation.

Who is State Farm’s biggest competitor?

Geico is one of State Farm’s biggest competitors by market share (Read More: Geico Auto Insurance Review)

Who is the most trustworthy insurance company?

Allstate has better financial ratings than State Farm.

Which insurance company is best at paying claims?

State Farm has slightly better ratings than Allstate for customer claim satisfaction.

Which insurance company has the highest customer satisfaction?

State Farm has slightly better customer claim satisfaction ratings than Allstate.

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.