Lemonade vs. Safeco Renters Insurance in 2024 (Best Value Revealed)

When it comes to Lemonade vs. Safeco renters insurance, Lemonade renter's insurance rates start at $12/mo, compared to Safeco's starting rate of $18/mo. However, Safeco renters insurance has better business ratings and renters coverage options than Lemonade renters insurance.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Nov 25, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

1,173 reviews

1,173 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

1,173 reviews

1,173 reviewsWhen you compare Lemonade vs. Safeco renters insurance, Lemonade has cheaper rates for renters on average, but Safeco has better customer and business reviews.

Renters insurance is crucial for anyone renting a home or apartment, as it offers protection and peace of mind in case of unexpected events or disasters.

Lemonade vs. Safeco Renters Insurance Rating| Rating Criteria |  | |

|---|---|---|

| Overall Score | 3.9 | 4.2 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 4.0 | 2.5 |

| Company Reputation | 4.0 | 4.0 |

| Coverage Availability | 4.3 | 5.0 |

| Coverage Value | 3.5 | 3.9 |

| Customer Satisfaction | 4.8 | 3.9 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.8 | 4.3 |

| Plan Personalization | 4.0 | 4.5 |

| Policy Options | 2.2 | 5.0 |

| Savings Potential | 4.2 | 4.5 |

| Lemonade Review | Safeco Review |

In this article, we will explore the key features and benefits of Lemonade and Safeco renters insurance, and compare them to help you make an informed decision about your home and renters insurance. Or, use our free quote tool to find an affordable renters insurance company in your area today.

- Lemonade renters insurance is usually cheaper than Safeco

- Safeco has better business ratings than Lemonade

- Safeco renters coverage is more widely available than Lemonade

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Lemonade vs. Safeco Renters Insurance Rate Comparision

When it comes to prices between Lemonade and Safeco, Lemonade, Inc. often stands out for its affordability. By leveraging technology and reducing overhead costs, Lemonade can offer competitive rates to their customers.

Lemonade vs. Safeco Full Coverage Renters Insurance Monthly Rates by Age & Gender| Age & Gender |  | |

|---|---|---|

| Age: 16 Female | $12 | $18 |

| Age: 16 Male | $14 | $21 |

| Age: 30 Female | $15 | $24 |

| Age: 30 Male | $17 | $28 |

| Age: 45 Female | $19 | $29 |

| Age: 45 Male | $20 | $30 |

| Age: 60 Female | $21 | $31 |

| Age: 60 Male | $22 | $32 |

However, it’s important to compare quotes specific to your location and coverage needs to determine which provider offers the best value and coverage for your needs, especially if you are shopping for the best renters insurance for high-value items.

Lemonade vs. Safeco Renters Insurance Coverage Options

When diving into the specifics of Lemonade and Safeco, it’s essential to understand what renters insurance is and why it is important. Both companies offer basic renters policy that protect renters from financial loss related to their belongings, liability, and additional living expenses.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

While landlords typically have insurance that covers the building itself, it usually does not extend to the tenant’s personal belongings or liability.

That’s where renters insurance comes in, ensuring that you are protected in case of unfortunate events. See the exact details of what each company covers below.

Lemonade vs. Safeco Renters Insurance Coverage Availability| Coverage Type |  | |

|---|---|---|

| Personal Property | ✔️ | ✔️ |

| Liability | ✔️ | ✔️ |

| Loss of Use/Additional Living Expenses | ✔️ | ✔️ |

| Medical Payments to Others | ✔️ | ✔️ |

| Replacement Cost Coverage | ✔️ | ✔️ |

| Scheduled Personal Property (for high-value items) | ✔️ | ✔️ |

| Water Backup | ❌ | ✔️ |

| Identity Theft Protection | ❌ | ✔️ |

| Earthquake Coverage | ❌ | ✔️ |

| Pet Damage Liability | ✔️ | ❌ |

Lemonade Insurance Agency does have fewer coverage options than Safeco, although Safeco doesn’t offer pet liability insurance. However, if you live in a high-risk area, you may want to opt for Safeco for more protection options (Read More: Best Renters Insurance for People Living in High-Risk Areas).

Renters Coverage Options with Lemonade

Lemonade offers a broad range of coverage options to meet different needs and budgets. Their policies typically cover personal belongings against theft, fire, vandalism, and certain weather-related events. Lemonade personal liability insurance is included to protect you if someone files a claim against you for injury or property damage.

Additionally, Lemonade’s renters insurance can provide coverage for loss of use, ensuring that you have temporary accommodations if your rental becomes uninhabitable.

But Lemonade Insurance Company doesn’t stop there with just Lemonade personal liability. They understand that every individual has unique needs and preferences, which is why they offer additional coverage options that can be added to your policy. These options include coverage for valuable items, such as jewelry or electronics, and even coverage for your furry friends, protecting you from liability if your pet causes damage or injury.

Lemonade’s flexible coverage options allow you to customize your policy to fit your specific circumstances, giving you peace of mind knowing that you are adequately protected.

Renters Coverage Options with Safeco

One of the advantages of Safeco renters insurance is the ability to customize your policy to fit your specific needs. Safeco Insurance Company offers various options to ensure that you have the coverage you require.

First and foremost, Safeco provides coverage for personal property, including furniture, electronics, and clothing, against covered perils. This means that your most valuable possessions are protected in case of theft, fire, or other covered events.

In addition to personal property coverage, Safeco includes liability coverage in their renters insurance policies. This coverage protects you from legal and medical expenses if someone gets injured in your rental unit. It offers you peace of mind, knowing that you are financially protected in case of accidents.

Furthermore, Safeco’s policies can cover loss of use, providing you with additional living expenses if your rental becomes uninhabitable. This coverage can help with hotel costs, meals, and other necessary expenses while you are unable to live in your rental. It ensures that you are not left stranded in a difficult situation.

Lemonade vs. Safeco Discount Options

Both Lemonade and Safeco offer discounts on their renters’ insurance policies, but Safeco offers a few more than Lemonade.

Renters’ Insurance Discounts: Lemonade vs. Safeco| Discount Name | ||

|---|---|---|

| Bundling | 10% | 10% |

| Claim-Free | 5% | 10% |

| Loyalty | X | 5% |

| Security System | 5% | 5% |

| Multi-Policy | 10% | 15% |

| Paperless Billing | X | 1% |

Safeco has a bundling discount to help you save on renters or home insurance if you bundle it with auto insurance (Read More: Stop Overpaying For Auto and Home Insurance). Lemonade doesn’t have a bundling discount, though, so you won’t save if you also purchase Lemonade motorcycle insurance or Lemonade rental car insurance with your renters’ policy.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Lemonade vs. Safeco Customer Reviews

Customer service is an essential aspect of any insurance provider. Lemonade Insurance differentiates itself by providing a modern and streamlined claims process. Their mobile app allows for easy claims filing, and their goal is to process claims quickly, aiming to provide a hassle-free experience. However, some customers on Reddit have had issues with the AI processing of Lemonade’s claims.

Issues with Lemonade customer service and claims filing have led to multiple complaints on sites like Reddit from tenants with Lemonade rental coverage (Read More: Who is a tenant?).

Reddit is a great place to check reviews, whether you are looking for Lemonade pet insurance reviews on Reddit or Goodcover vs. Lemonade reviews.

Safeco, as a more traditional insurer, also prides itself on providing reliable customer service. They have a network of agents available to assist policyholders with any inquiries or assistance they may need throughout the claims process or policy term. Most customer reviews on Reddit about claims are positive, although customers have complained about rate increases.

In conclusion, both Lemonade and Safeco offer renters insurance policies that can provide valuable protection for renters. While Lemonade stands out for its competitive pricing, customers may run into issues with the AI technology slowing down claims. While Safeco emphasizes its long-standing reputation and comprehensive coverage options, customers may see rate increases.

By carefully reviewing their offerings and comparing them based on your specific needs, you can make an informed choice and secure the right renters insurance for you.

Lemonade vs. Safeco Business Reviews

No matter what companies you are comparing, whether Safeco vs. Amica or State Farm vs. Safeco, business ratings will give you a quick insight into which company is more reputable. While Lemonade may be more affordable than Safeco Insurance, comparing business reviews shows that Safeco has better business ratings than Lemonade.

Insurance Business Ratings & Consumer Reviews: Lemonade vs. Safeco| Agency |  | |

|---|---|---|

| Score: 807 / 1,000 Below Avg. Satisfaction | Score: 844 / 1,000 Above Avg. Satisfaction |

|

| Score: B Fair Business Practices | Score: A Excellent Business Practices |

|

| Score: 70/100 Average Customer Satisfaction | Score: 74/100 Good Customer Feedback |

|

| Score: 2.50 More Complaints Than Avg. | Score: 0.90 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A Excellent Financial Strength |

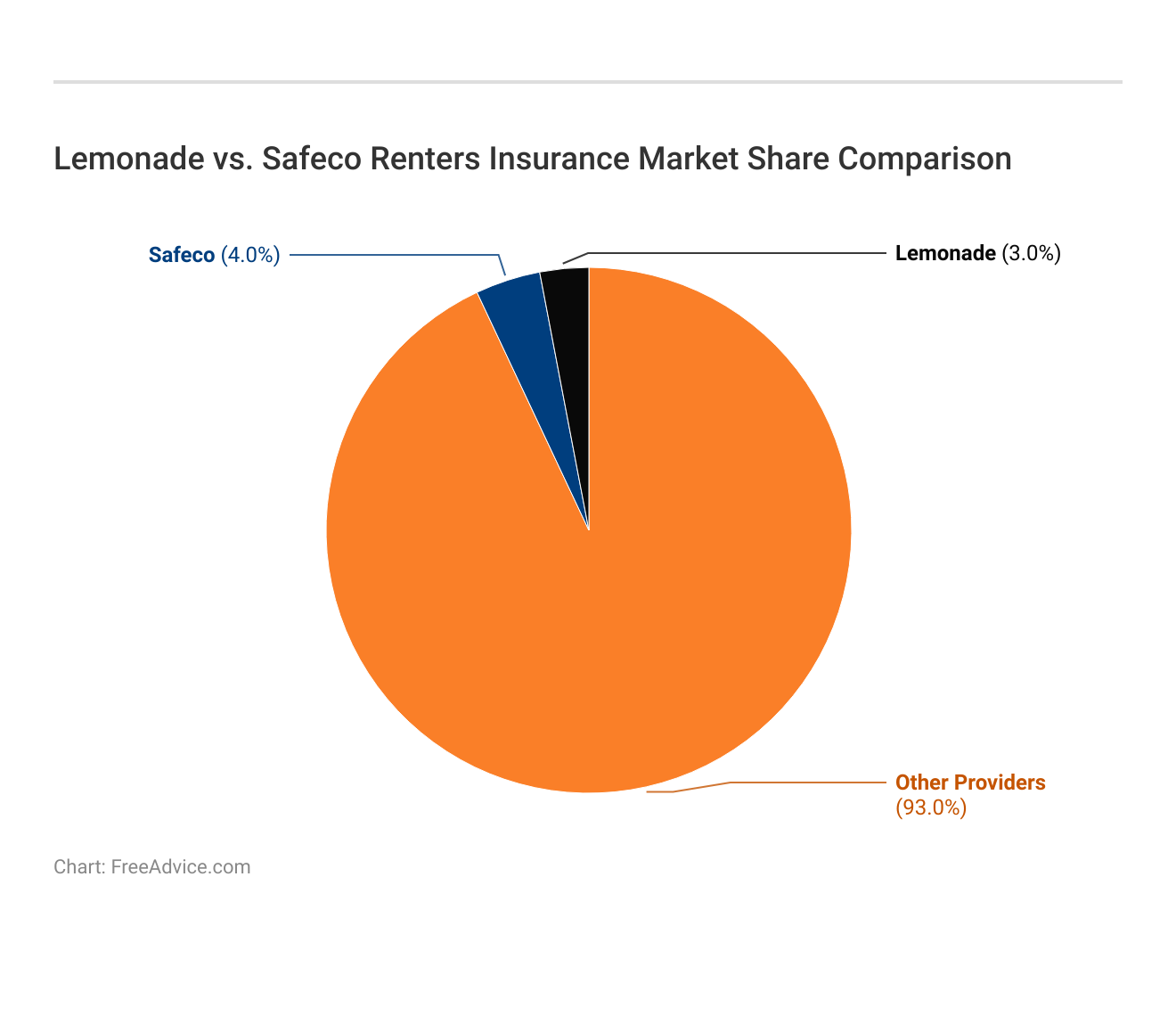

Safeco did better than Lemonade for the majority of business ratings except for financial stength, where both companies scored the same. However, Safeco does have a larger market share than Lemonade, so it is more firmly established in the insurance industry.

If you are still having trouble picking between the two companies, read on for the pros and cons of Lemonade and Safeco.

Pros and Cons of Lemonade Renters Insurance

Lemonade is a relatively new player in the insurance industry that offers innovative, technology-driven solutions. Their goal is to provide affordable and transparent coverage to consumers while making the claims process fast and straightforward. Some of the main advantages of Lemonade include:

- Competitive Pricing: Lemonade’s significant advantage is its competitive pricing. Through its online platform, Lemonade offers policies at affordable rates, making insurance more accessible to a wider audience.

- Basic Rental Coverage: Lemonade offers coverage for a variety of issues that renters may experience on their property, including pet coverage (Read More: Lemonade Pet Insurance Review).

- Online Services: Lemonade is convenient for customers who want to manage policies online. Their claims process, as mentioned earlier, is also quick.

Not everything about Lemonade is great, though, and there are a few potential drawbacks to consider.

- State Availability: Lemonade’s coverage may not be available in all areas, so it’s essential to check if they operate in your location. Additionally, their policies may have limitations or exclusions, so it’s crucial to carefully review and understand the terms before purchasing.

- Business and Customer Ratings: Lemonade scored lower than Safeco in most areas of customer satisfaction and business practices.

In conclusion, Lemonade’s renters insurance offers a refreshing alternative to traditional insurance providers. With its innovative technology, comprehensive coverage options, and commitment to social good, Lemonade is redefining the insurance industry and putting the needs of its customers first. However, customers may run into issues with claim payouts and customer service.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of Safeco Renters Insurance

Safeco is a well-established insurance company with a long history of providing reliable coverage to customers. There are several advantages to choosing Safeco renters insurance.

- Business Ratings: Safeco’s reputation as an established and reliable insurance company is a significant advantage. With Safeco, you can trust that you are dealing with a company that has a strong financial standing and a long history of serving policyholders.

- Comprehensive Rental Coverage: Safeco’s coverage options are comprehensive, ensuring that you have the protection you need in various scenarios. Their policies cover personal belongings, tenant liability, and additional living expenses, providing you with peace of mind (Learn More: Is tenant liability the same as renters insurance?).

- Availability: Safeco renters insurance is available in more states than Lemonade. However, because availability may vary by location, it’s important to verify if they offer coverage in your area before making a decision.

The downsides to Safeco include:

- Higher Renters Rates: Customers may find Safeco’s pricing slightly higher than that of newer, online-focused insurance providers like Lemonade.

- No Pet Liability: Safeco has more coverage options than Lemoande, but it is missing pet coverage for renters.

In conclusion, Safeco renters insurance is a reliable and comprehensive option for renters who value the protection of their personal belongings, liability coverage, and additional living expenses. With its long-standing reputation and commitment to customer satisfaction, Safeco is worth considering when looking for renters insurance.

However, while Safeco offers quality coverage, it’s always a good idea to compare quotes to ensure that you are getting the best value for your money.

Importance of Renters Insurance

Renters insurance is crucial for several reasons. Firstly, it protects your personal belongings. Imagine the financial burden of replacing all your furniture, electronics, and clothing after a fire. With renters insurance, you can recover the value of your damaged or stolen items, allowing you to start anew.

In addition to protecting your belongings, renters insurance also offers liability coverage. Accidents can happen, and if someone gets injured on your rental property, you could be held responsible. Renters insurance provides coverage for legal expenses and damages awarded in such situations, helping you avoid significant financial strain.

Furthermore, renters insurance offers peace of mind. Knowing that you are financially protected in case of unforeseen events can alleviate stress and allow you to fully enjoy your rental property. Whether it’s a burst pipe that damages your furniture or a guest slipping and falling in your apartment, renters insurance can provide the necessary support, whether you are living in a high-rise apartment or a suburban home.

Read More: Best Renters Insurance for People Living in High-Rise Apartments

Another reason why renters insurance is important is that it may include loss of use coverage. Suppose your rental becomes uninhabitable due to a covered event, such as a fire or flood. In that case, it can help cover the cost of temporary accommodations or additional living expenses until your rental is repaired or you find a new place to live. This coverage can be invaluable during times of displacement and uncertainty.

Kristen Gryglik Licensed Insurance Agent

Lastly, renters insurance is relatively affordable. The cost of renters insurance is typically much lower than other types of insurance, such as homeowners insurance. For a small monthly premium, you can have peace of mind and financial protection, making it a worthwhile investment for renters.

In conclusion, renters insurance is a crucial aspect of renting a home or apartment. It provides coverage for personal belongings, liability, and additional living expenses. With renters insurance, you can protect your possessions, avoid financial strain in case of accidents, and have peace of mind knowing that you are covered.

So, before you move into your next rental property, make sure to consider the importance of renters insurance and find a policy that suits your needs.

Introduction to Lemonade Renters Insurance

Founded in 2015, Lemonade has quickly gained recognition for its unique approach to renters insurance. By leveraging artificial intelligence and machine learning algorithms, they aim to disrupt the traditional insurance model and provide a more efficient and customer-centric experience to protect renters and homeowners from everything from fallen trees to stolen goods.

Read More: Does Lemonade homeowners insurance cover fallen trees?

But it’s not just about affordability and convenience. Lemonade has also made a commitment to social good. They have pioneered the concept of “Giveback,” where any unclaimed money left after paying claims is donated to charitable causes chosen by their customers. This unique approach sets Lemonade apart from traditional insurers and resonates with customers who want their insurance provider to make a positive impact on society.

With their user-friendly platform and commitment to social good, Lemonade has attracted a growing number of customers who appreciate their modern approach to insurance.

Overview of Lemonade Renters Insurance

Lemonade offers renters insurance policies that are tailored to individual needs. Their policies include coverage for personal belongings, liability, and loss of use. Lemonade’s coverage extends beyond the rental property, protecting your belongings even when you are away from home.

When you purchase a Lemonade renters insurance policy, you can rest assured knowing that your personal belongings are protected against a range of perils. Whether it’s theft, fire, vandalism, or certain weather-related events, Lemonade has you covered.

Learn More: What are 3 examples of things that could occur that renter’s insurance would not cover?

But Lemonade’s commitment to its customers goes beyond just covering the cost of replacing your belongings. They understand that accidents happen, and that’s why their policies also include Lemonade liability coverage.

Liability means that if someone files a claim against you for injury or property damage, Lemonade will help protect your finances by covering legal expenses and potential settlements.

Additionally, Lemonade’s renters insurance can provide coverage for loss of use. Imagine a scenario where your rental becomes uninhabitable due to a fire or other covered peril. In such cases, Lemonade will ensure that you have temporary accommodations, helping you get back on your feet as quickly as possible.

One of Lemonade’s standout features is its fast and easy claims process. Traditional insurers often have complex and time-consuming claim procedures, but Lemonade aims to simplify things by leveraging technology. Claims can be filed through its mobile app, and it strives to process them within minutes, not days.

By utilizing artificial intelligence, Lemonade can analyze claims data, detect potential fraud, and make decisions faster. This not only speeds up the claims process but also reduces the administrative burden on their customers.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Introduction to Safeco Renters Insurance

They have been serving policyholders for many years, earning a reputation for their commitment to customer satisfaction. Safeco offers a wide range of insurance products, including renters insurance, designed to meet the needs of renters with reasonable premiums.

Learn More: How can I pay my Safeco insurance premium?

When it comes to protecting your belongings and ensuring your peace of mind, Safeco understands the importance of comprehensive coverage. Their renters insurance policies are specifically designed to give renters the protection they need in case of unexpected events.

Overview of Safeco Renters Insurance

Safeco’s renters insurance policies offer comprehensive coverage for personal belongings, liability, and additional living expenses. They understand that your personal belongings hold both sentimental and monetary value, which is why they offer coverage for personal belongings against theft, fire, and certain weather-related events.

But Safeco doesn’t stop there. They also include liability coverage in their renters insurance policies, protecting you in case someone is injured in your rental or if you accidentally damage someone else’s property. This added layer of protection ensures that you are financially secure in case of unexpected accidents.

Furthermore, Safeco provides coverage for loss of use, ensuring that you have a safe place to stay if your rental becomes temporarily uninhabitable. This coverage can be a lifeline during difficult times, as it helps with hotel costs, meals, and other necessary expenses while you are unable to live in your rental.

Choosing Between Lemonade and Safeco Renters Insurance

When it comes to Lemonade vs. Safeco, Lemonade renters insurance reviews are worse than Safeco’s, but Lemonade does have cheaper prices. However, while both Lemonade and Safeco offer comprehensive coverage options for personal belongings, liability, and loss of use, you will get more coverage and discount options when buying renters insurance at Safeco.

Dani Best Licensed Insurance Producer

No matter what renters insurance you are researching for, whether the best renters insurance for freelancers or Mercury vs. Safeco renters insurance, make sure to consider the rates and coverages. If Safeco vs. Lemonade is not right for you, find affordable renters insurance in your area by entering your ZIP in our free tool.

Frequently Asked Questions

What is the difference between Lemonade and Safeco renters insurance?

Lemonade and Safeco are both insurance companies that offer renters insurance policies. However, there are some differences between them. Lemonade is a digital-first insurance company that uses artificial intelligence and automation to provide affordable and easy-to-understand policies.

Safeco, on the other hand, is a traditional insurance company that offers a wide range of insurance products, including renters insurance. The main difference lies in the way they operate and the customer experience they provide.

Which company offers better coverage for renters insurance?

Both Lemonade and Safeco offer comprehensive coverage for renters insurance. The best coverage for you depends on your specific needs and preferences. Your needs when shopping for the best renters insurance for seniors will be different than shopping for family renter’s insurance.

Lemonade is known for its transparent and hassle-free claims process, while Safeco offers a variety of coverage options and additional endorsements that can enhance your policy. It is recommended to compare the coverage options, limits, deductibles, and additional features offered by both companies to determine which one suits you better.

Is Lemonade or Safeco renters insurance cheaper?

Lemonade is often considered more affordable than Safeco for renters insurance. Lemonade’s pricing is based on a flat fee, and any unclaimed money is donated to charitable causes through their Giveback program.

Safeco’s pricing may vary depending on factors such as location, coverage limits, deductibles, and additional endorsements. It is advisable to obtain quotes from both companies and compare them to find the most cost-effective option for your specific situation.

Can I switch from Safeco to Lemonade for my renters insurance?

Yes, you can switch from Safeco to Lemonade for your renters insurance. However, before making the switch, it is important to review the terms and conditions of your Safeco policy, including any cancellation fees or requirements.

Additionally, ensure that Lemonade offers coverage in your area and meets your specific insurance needs. Once you have done your research and made an informed decision, you can cancel your Safeco policy and purchase a renters insurance policy from Lemonade.

Does Lemonade or Safeco have better customer reviews for renters insurance?

Both Lemonade and Safeco have a mix of positive and negative customer reviews for their renters insurance. Lemonade rental insurance is often praised for its user-friendly app, quick claims process, and transparent policies. Safeco, being a larger and more traditional insurance company, has a wider range of customer experiences.

It is recommended that you read customer reviews and ratings from reliable sources to better understand others’ experiences with Lemonade and Safeco renters insurance. If you have experience with either company, or experience with companies like Farmers vs. Safeco, leaving a review will also help other shoppers (Learn More: Can You Get in Trouble for Leaving an Online Review?).

Does the Lemonade renters insurance cancellation policy offer refunds?

Yes, if you prepaid for Lemonade rental insurance, you will get a refund for unused premiums on your renters insurance from Lemonade.

Is there a Lemonade renters insurance promo code?

Lemonade may occasionally run deals on Lemonade apartment renters insurance, which can be useful if your renters insurance recently went up (Read More: What causes renters insurance to go up?). You will have to check the website to see if there are any promo codes.

Is Lemonade renters insurance good?

Lemonade renters insurance is good if you are looking for a quick, cheap policy to get immediately. However, it has worse reviews and ratings than Safeco renter insurance. Whether you are comparing Nationwide vs. Safeco or Lemonade vs. State Farm, make sure to read reviews, compare coverages, and get quotes to find the best option for you.

How to cancel Lemonade renters insurance?

If you want to cancel Lemonade renters insurance, you can do so online or call customer service (Learn More: How To Cancel Renters Insurance).

Is there Lemonade renters insurance in Texas?

Yes, Lemonade sells tenant insurance for renters in Texas. If you want more renters insurance options in Texas, you can also enter your ZIP code in our free tool. Or, do research into popular options like Allstate vs. Safeco

What is Safeco’s company name?

Safeco is short for Selective Auto and Fire Ensurance Company of America.

What is the Lemonade renters insurance phone number?

Lemonade’s customer service number is (844) 733-8666.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.