Nationwide Car Insurance Review for 2024 (See Actual Rates)

Our Nationwide car insurance review found it stands out as an excellent choice for good drivers. It's ideal for drivers who prioritize financial strength and add-on coverages, with rates starting at $39/mo. Nationwide auto insurance isn't available in Alaska, Hawaii, Louisiana, or Massachusetts.

Free Insurance Quote Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Dec 9, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

This Nationwide car insurance review found that the company has reasonable rates and strong financial stability, with an A+ rating from A.M. Best.

Nationwide’s pricing falls near the U.S. average, offering good value for full coverage auto insurance, especially for drivers with clean records.

However, while its coverage options—such as roadside assistance and custom equipment coverage—are appealing, some customers have reported delays in claims processing.

Nationwide Car Insurance Rating| Rating Criteria |  |

|---|---|

| Insurance Rating | 4.5 |

| Business Reviews | 4.5 |

| Claim Processing | 5.0 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.3 |

| Customer Satisfaction | 4.7 |

| Digital Experience | 4.5 |

| Discounts Available | 3.5 |

| Insurance Cost | 4.4 |

| Plan Personalization | 4.5 |

| Policy Options | 4.0 |

| Savings Potential | 4.6 |

Nationwide is ideal for drivers seeking a balance of affordability and comprehensive coverage, but comparing quotes from multiple providers is always recommended to ensure the best deal. Get quotes today by entering your ZIP in our free tool.

- Nationwide auto insurance rates start at $39/mo

- Nationwide members can get a discount for bundling policies

- Nationwide auto insurance is not available in four states

Nationwide Car Insurance Rates

Cost is often one of the most important factors customers are interested in when shopping for car insurance, so we will do an in-depth breakdown of rates at Nationwide Mutual Insurance Company.

Rates will change at Nationwide based on factors such as your age (Read More: Average Auto Insurance Rates by Age and Gender). The more driving experience you have, the less you will pay for Nationwide coverage.

Nationwide Car Insurance Monthly Rates by Coverage Level, Age, & Gender| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $161 | $411 |

| Age: 16 Male | $195 | $476 |

| Age: 18 Female | $167 | $303 |

| Age: 18 Male | $131 | $387 |

| Age: 25 Female | $131 | $136 |

| Age: 25 Male | $57 | $150 |

| Age: 30 Female | $48 | $124 |

| Age: 30 Male | $53 | $136 |

| Age: 45 Female | $43 | $113 |

| Age: 45 Male | $44 | $115 |

| Age: 60 Female | $39 | $99 |

| Age: 60 Male | $41 | $104 |

| Age: 65 Female | $43 | $111 |

| Age: 65 Male | $43 | $112 |

Of course, even older drivers may still have high auto insurance rates if they don’t have a safe driving record.

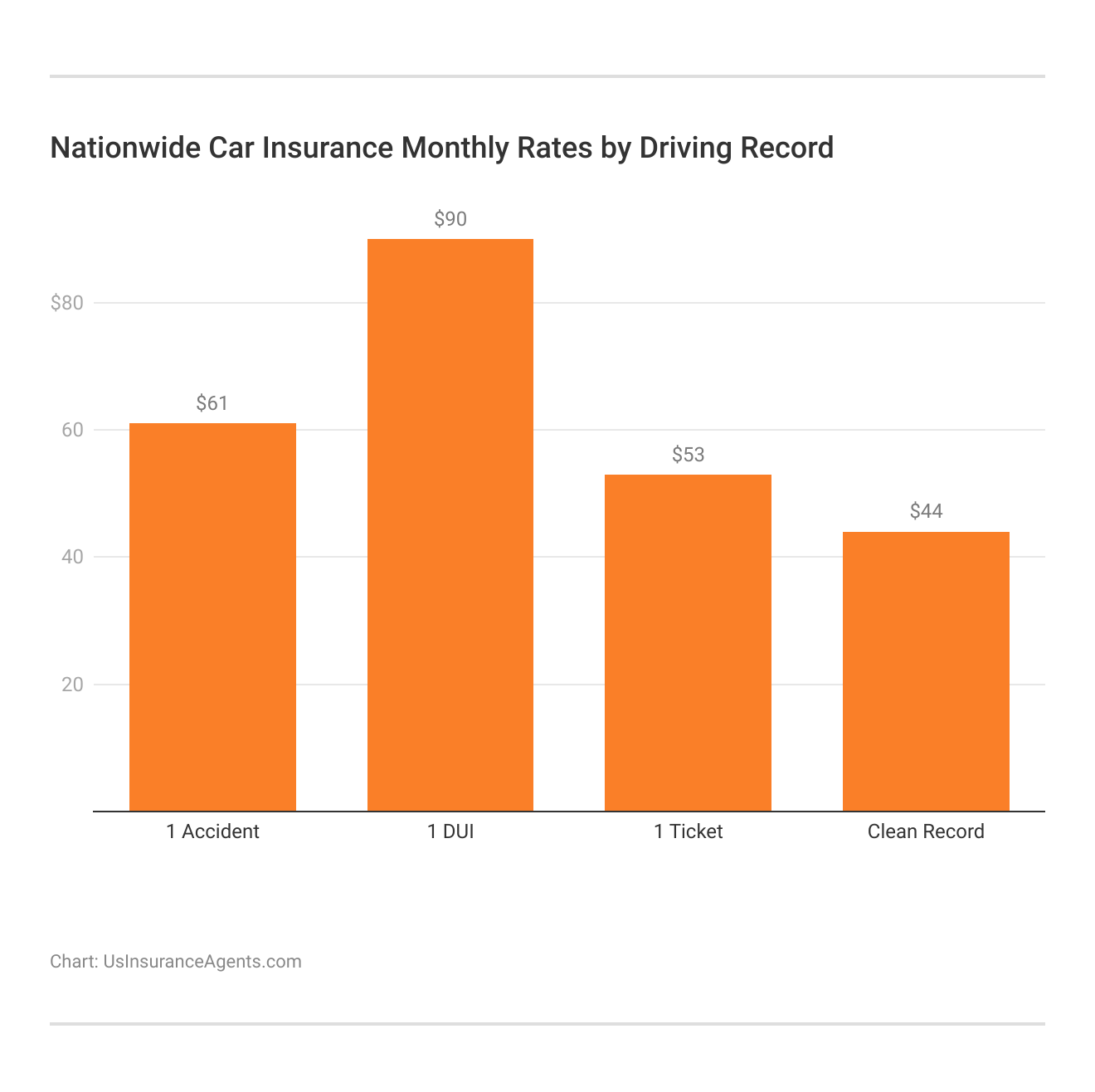

Drivers with tickets, accidents, or DUIs are more likely to file a claim, so they will pay higher auto insurance rates at Nationwide.

Because all companies raise rates for high-risk drivers, the only way to know if Nationwide offers a reasonable price is to compare rates at Nationwide Insurance to other companies’ rates. You can get a Nationwide insurance quote directly from the company.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

You can also use a quote comparison tool to get quotes if you want to compare multiple companies’ rates at one time instead of just getting a Nationwide car insurance quote.

Nationwide Car Insurance Rates vs. the Competition

Because age is a major factor affecting the price you pay for auto insurance, let’s start by seeing how much Nationwide and other companies charge based on age and gender.

Nationwide Monthly Car Insurance Rates Compared to Competitors by Age & Gender| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $350 | $400 | $135 | $145 | $125 | $130 | $95 | $100 | |

| $290 | $350 | $115 | $125 | $105 | $110 | $80 | $85 | |

| $270 | $330 | $105 | $115 | $95 | $100 | $75 | $80 |

| $360 | $420 | $140 | $150 | $130 | $135 | $100 | $105 | |

| $280 | $340 | $110 | $120 | $100 | $105 | $75 | $80 | |

| $330 | $390 | $130 | $140 | $120 | $125 | $90 | $95 |

| $320 | $370 | $120 | $130 | $110 | $115 | $85 | $90 |

| $340 | $390 | $130 | $140 | $120 | $125 | $90 | $95 | |

| $300 | $350 | $115 | $125 | $105 | $110 | $80 | $85 | |

| $330 | $390 | $125 | $135 | $115 | $120 | $90 | $95 |

| $310 | $370 | $125 | $135 | $115 | $120 | $85 | $90 | |

| $250 | $310 | $100 | $110 | $90 | $95 | $70 | $75 |

For auto insurance with Nationwide compared to the top competitors, Nationwide falls right in the middle. Nationwide is on your side with a fair balance of affordability and coverage.

However, Geico wins for having the cheapest minimum coverage rates for teens, with rates for male teens starting at $280 per month on average (Learn More: Geico Auto Insurance Review).

With Nationwide, monthly minimum coverage for male teens climbs up to $320. But keep in mind, it’s not all about the cost. Nationwide probably wins in other categories.

Brandon Frady Licensed Insurance Producer

Next, let’s move on to compare Nationwide auto insurance rates to other popular companies by driving record.

Nationwide Monthly Car Insurance Rates Compared to Competitors by Driving Record| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $120 | $150 | $180 | $220 | |

| $105 | $130 | $165 | $190 | |

| $95 | $120 | $150 | $180 |

| $125 | $155 | $190 | $230 | |

| $100 | $125 | $155 | $185 | |

| $115 | $145 | $175 | $210 |

| $110 | $130 | $160 | $200 |

| $120 | $150 | $180 | $225 | |

| $110 | $135 | $170 | $200 | |

| $115 | $140 | $175 | $220 |

| $105 | $130 | $165 | $190 | |

| $90 | $115 | $140 | $180 |

Once again, Nationwide falls in the middle for affordability. However, while companies like Erie may have lower rates than Nationwide, bear in mind that Nationwide is available in more locations than Erie.

Nationwide Car Insurance Coverage Options

Nationwide has a great selection of add-on coverages for customers, as well as several coverage perks like accident forgiveness.

Nationwide Car Insurance Coverage Options| Coverage Option | Description |

|---|---|

| Accident Forgiveness | Prevents premium increases after your first at-fault accident |

| Classic Car Insurance | Specialized coverage for antique or collector vehicles |

| Collision Coverage | Pays for damage to your car after an accident, regardless of fault |

| Comprehensive Coverage | Covers non-collision-related damage to your car (e.g., theft, weather, vandalism) |

| Custom Equipment Coverage | Covers aftermarket or custom parts added to your vehicle |

| Gap Insurance | Covers the difference between your car’s value and the amount you owe on it |

| Liability Coverage | Covers damages or injuries to others in an accident you cause |

| Medical Payments (MedPay) | Covers medical expenses for you and passengers regardless of fault |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers |

| Rental Car Reimbursement | Pays for a rental car if your vehicle is being repaired after a covered claim |

| Ride-Share Coverage | Extends coverage for drivers using their cars for ride-sharing services |

| Roadside Assistance | Provides help for common roadside issues like towing, flat tires, and lockouts |

| Total Loss Deductible Waiver | Waives your deductible if your car is deemed a total loss after an accident |

| Uninsured/Underinsured Motorist | Protects you if the at-fault driver has no insurance or insufficient coverage |

| Vanishing Deductible | Reduces your deductible by $100 for each year of safe driving (up to $500) |

While you can certainly carry just the bare minimum, you can also beef up your car insurance policy with Nationwide’s add-ons, like roadside assistance or rental reimbursement coverage (Learn More: Best Car Insurance With Rental Reimbursement Coverage).

Nationwide is a great choice if you have a vehicle that you want less-commonly offered coverage for, such as custom equipment coverage.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Nationwide Car Insurance Discounts

If your Nationwide auto insurance rates are high, you can apply for discounts to try and lower them to a more reasonable rate, such as bundling coverages (Read More: Can I bundle my Nationwide car insurance with other policies?).

Nationwide Car Insurance Discounts and Percentage| Discount Type | Details | Percentage Savings |

|---|---|---|

| Multi-Policy Discount | Bundle auto insurance with home, renters, or life insurance | 25% |

| Multi-Vehicle Discount | Insure two or more vehicles on the same policy | 20% |

| Safe Driver Discount | Maintain a clean driving record for a specified period | 30% |

| Defensive Driving Course | Complete an approved defensive driving or driver safety course | 15% |

| Accident-Free Discount | Remain accident-free for a specific number of years | 15% |

| SmartRide Program (Telematics) | Use the SmartRide device or app to track safe driving habits | 40% |

| SmartMiles Program (Pay-per-mile) | Save based on actual miles driven (ideal for low-mileage drivers) | Varies |

| Good Student Discount | Available to full-time students with a “B” average or better | 15% |

| Affinity Member Discount | Offered to members of partner organizations or employers | 10% |

| Anti-Theft Device Discount | Install an approved anti-theft system in your vehicle | 15% |

| Paperless Billing Discount | Opt for electronic statements and automatic payments | $10/month |

| New Car Discount | Available for vehicles less than 3 years old | 10% |

| Family Plan Discount | Offered to young drivers remaining on their parent’s policy | 10% |

| Early Quote Discount | Get a quote and sign up at least 7–10 days before the policy starts | 10% |

Nationwide’s telematics program can be one of its biggest savers, but the percentage you save is based on the driving score you receive in the program.

Nationwide Customer Reviews

Nationwide has some positive Nationwide insurance Google reviews and Nationwide insurance reviews on Reddit, like the Reddit review below.

However, some customer complaints have surfaced, especially when it comes to Nationwide’s insurance claims process. Sure, you can call the Nationwide insurance phone number or their claims number directly to start a claim, but it’s not always as straightforward as it sounds.

Learn More: How to File a Car Insurance Claim With Nationwide General Insurance Company

For example, policyholders have reported long delays after filing insurance claims with Nationwide.

Anyone currently dealing with Nationwide auto insurance and they are very slow?

byu/usertree232 inInsurance

And a much more serious accusation is that Nationwide denies claims that customers believe should have been approved. The claims process is one of the biggest factors you should consider when choosing your insurance provider.

Nationwide Business Ratings

Customer reviews and filed complaints are just one aspect of reviewing a company (Learn More: How to File a Complaint with Your State Department of Insurance). You also want to check business ratings and reviews, such as Nationwide insurance reviews on Consumer Reports.

Nationwide Car Insurance Business Ratings & Consumer Reviews| Agency |  |

|---|---|

| Score: A+ Superior Financial Strength |

| Score: A+ Excellent Business Practices |

|

| Score: 75/100 Positive Customer Feedback |

|

| Score: 855 / 1,000 Above Avg. Satisfaction |

|

| Score: 0.78 Fewer Complaints |

Nationwide is a big company with very strong finances, which is good news for policyholders.

Dani Best Licensed Insurance Producer

The A.M. Best rating for Nationwide is great, as it is as superior as it gets in the auto insurance game.

The Better Business Bureau (BBB) also gives Nationwide an A+ rating based on Nationwide insurance reviews on BBB and business practices.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Nationwide Car Insurance Pros and Cons

Nationwide auto insurance has some strong points working in its favor, as it is a well-established company.

- Reasonable Rates: When it comes to price point, Nationwide’s car insurance premiums fall right around the U.S. average, which is great.

- Financial Rating: Nationwide has an A+ rating from A.M. Best, which is a solid indicator of their financial stability.

- Coverage Choices: Nationwide sells add-ons like custom equipment coverage and roadside assistance for towing (Read More: Does Nationwide offer towing and labor coverage?).

There are plenty of great pros to recommend Nationwide as a company, as it has reasonable prices and great coverage options.

However, this doesn’t mean that there aren’t some cons to Nationwide as an auto insurance company.

- Customer Reviews: Some policyholders haven’t been thrilled with Nationwide’s claims process, and the overall customer satisfaction ratings could be better.

- Availability by State: Nationwide is available in most of the U.S., but it doesn’t sell auto insurance in Alaska, Hawaii, Louisiana, or Massachusetts.

For the most part, Nationwide’s pros outweigh the cons. However, we recommend always getting quotes from a few companies before deciding, as this will help you get the best deal on insurance in your state.

Choosing Nationwide as a Provider

Our Nationwide car insurance review found that it has reasonable rates that fall close to the U.S. average. Nationwide stands out by offering extensive availability across the U.S. Drivers seeking solid auto insurance coverage options and competitive pricing will benefit most from Nationwide’s offerings.

However, customers report the occasional delay in the claims process, and Nationwide auto insurance coverage isn’t available in a few states.

It’s essential to compare car insurance quotes from multiple providers to ensure the best deal tailored to your needs. Explore different options with our free quote tool to find the most cost-effective policy available in your state.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Nationwide a reputable insurance company?

So, how trustworthy is Nationwide? Nationwide is a reputable insurance company that has high ratings from businesses like BBB and A.M. Best.

What is the most trusted car insurance company?

One of the most trusted car insurance companies with high customer satisfaction ratings is USAA, but it only sells insurance to military and veteran customers.

Did car insurance rates go up at Nationwide?

Like most companies, Nationwide has slightly increased its rates over the years to account for inflation, accident claims, and other incidents (Learn More: Why Auto Insurance Rates Go Up).

Why is my Nationwide car insurance so high?

Your Nationwide rates may be high for a number of reasons, from driving infractions to the area you live in. If you’ve already applied discounts to your Nationwide policy and still need lower rates, shop around for quotes with our free tool.

Is Nationwide the most expensive?

No, Nationwide is not the most expensive company on the market for auto insurance.

How can I lower my car insurance rate?

To lower your Nationwide car insurance rate, you can apply for discounts like a bundling discount for home and auto insurance. Just read Nationwide homeowners insurance reviews to ensure its home insurance is also the right fit for you. Keeping a clean driving record or lowering deductibles will also make rates affordable (Read More: How to Lower Your Car Insurance by Choosing the Best Deductible).

Who normally has the cheapest car insurance?

USAA usually has the cheapest car insurance, with full coverage rates for a clean driving record starting at $90/mo. However, USAA doesn’t offer as many coverage options as Nationwide.

Is Nationwide cheaper than Progressive?

Yes, Nationwide is cheaper than Progressive, as Progressive’s clean driving record full coverage rates start at $120/mo compared to $110/mo at Nationwide.

Is Nationwide the same as Allstate?

Wondering are State Farm and Allstate the same? While both companies sell auto insurance, the two companies are not the same (Learn More: Allstate Auto Insurance Review).

What company owns Nationwide Insurance?

Nationwide is not owned by another company.