State Farm vs. Country Financial Homeowners Insurance in 2024 (See Which Coverage Wins)

Decide which option works for you between State Farm vs. Country Financial homeowners insurance, with monthly rates starting at $62 with State Farm and $67 with Country Financial. This article provides an in-depth analysis of these two insurance providers, helping you make an informed decision for your home protection needs.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Nov 27, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Nov 27, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

Discover which option best fits your needs between State Farm and Country Financial homeowners insurance. Coverage plans start at $62 a month with State Farm and $67 with Country Financial.

Are you looking for homeowners insurance? With so many choices out there, it can be hard to find the right company for you. In this review, we’ll compare State Farm and Country Financial insurance reviews, two popular insurance providers, and explore how to keep your homeowners insurance rates from increasing while ensuring you get the coverage you need.

State Farm vs. Country Financial Homeowners Insurance Rating| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.3 | 4.5 |

| Business Reviews | 5.0 | 4.5 |

| Claim Processing | 4.3 | 4.0 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 3.9 |

| Coverage Value | 4.2 | 4.6 |

| Customer Satisfaction | 4.1 | 4.1 |

| Digital Experience | 4.5 | 4.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.9 | 4.8 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.8 | 5.0 |

| Savings Potential | 4.3 | 4.9 |

| State Farm Review | Country Financial Review |

Compare quotes from the cheapest home insurance companies by entering your ZIP code into our free tool above.

- State Farm leads in affordability and Country Financial in customer service

- A 45-year-old male pays lower premiums with State Farm

- Country Financial has a higher rating for customer satisfaction and reliability

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

State Farm vs. Country Financial: Compare Insurance Rates & Coverage Options

Homeowners insurance is essential for safeguarding your home, offering financial protection against damage or loss from perils like fire, theft, and natural disasters. It also includes liability coverage, which protects against legal or medical expenses if someone is injured on your property.

The table below shows the monthly rates for different groups. It highlights the differences between the two providers. The data also provides insights for those looking for the cheapest auto insurance companies.

State Farm vs. Country Financial Full Coverage Homeowners Insurance Monthly Rates by Age & Gender| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $150 | $160 |

| Age: 16 Male | $155 | $165 |

| Age: 30 Female | $75 | $80 |

| Age: 30 Male | $78 | $83 |

| Age: 45 Female | $65 | $70 |

| Age: 45 Male | $68 | $73 |

| Age: 60 Female | $62 | $67 |

| Age: 60 Male | $65 | $70 |

But what exactly should you look for when evaluating homeowners insurance policies? Let’s explore the key features in more detail:

Property Coverage

When comparing Country Financial vs State Farm, one of the most critical aspects of homeowners insurance is property coverage. Both companies provide comprehensive coverage for your dwelling and personal belongings. This ensures that if your home is damaged or destroyed, you will receive compensation to repair or replace your property.

Liability Coverage

Why you need home insurance liability coverage? If your home becomes uninhabitable due to a covered peril, coverage for additional living expenses is crucial.

Both insurers include this in their policies, helping pay for temporary living arrangements like hotel stays or rental properties while your home is being repaired or rebuilt.

Additional Living Expenses Coverage

In the event your home becomes uninhabitable due to a covered peril, additional living expenses coverage is crucial. Both insurers include this in their policies, helping pay for temporary living arrangements like hotel stays or rental properties while your home is being repaired or rebuilt.

Deductible Options

State Farm and Country Financial provide flexible deductible options, allowing you to select a deductible that matches your budget and risk tolerance. A higher deductible can lower your premium, but it also means you’ll pay more out of pocket if you need to file a claim. It’s essential to balance the deductible with your financial situation and risk preferences.

Insurance Discounts With State Farm vs. Country Financial

State Farm stands out with its multi-line discount for bundling policies and home security discounts for installing safety features like smoke detectors and security systems. Additionally, State Farm rewards owners of new or recently renovated homes with further discounts as well as State Farm mobile home insurance discounts. Country Financial, on the other hand, also provides a variety of discounts, including bundling discounts and rewards for claims-free histories.

Both companies offer discounts for proactive measures, such as installing smoke detectors and home security systems. Keep the cost of homeowners insurance down by making your home safe. While both State Farm and Country Financial strive to keep insurance affordable, each offers unique perks to help reduce premiums.

State Farm vs. Country Financial Customer and Business Reviews

Both State Farm and Country Financial ratings are high for excellent customer service and efficient claims handling but they have some pluses and minuses. State Farm does well on its 24-hour claims reporting hotline, easy-to-use website, and mobile app, which make managing policy and the filing of claims easy and simple. As you know, their claims representatives are dedicated to providing updates and resolving claims quickly with little stress.

On the flip side, Country Financial lets you report claims anytime, day or night. Their claims adjusters work hard to resolve issues quickly and fairly, but their process might not be as smooth as State Farm’s.

Brandon Frady LICENSED INSURANCE AGENT

J.D. Power rates both State Farm and Country Financial highly for customer satisfaction, but Country Financial excels in business practices and financial strength.

Insurance Business Ratings & Consumer Reviews: State Farm vs. Country Financial| Agency | ||

|---|---|---|

| Score: 877 / 1,000 Above Avg. Satisfaction | Score: 849 / 1,000 Above Avg. Satisfaction |

|

| Score: C- Below Avg. Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 75/100 Positive Customer Feedback | Score: 74/100 Good Customer Feedback |

|

| Score: 0.78 More Complaints Than Avg. | Score: 0.58 Fewer Complaints |

|

| Score: B Fair Financial Strength | Score: A+ Superior Financial Strength |

Consumer reports show State Farm with slightly better customer feedback but more complaints. Overall, Country Financial stands out for its superior business practices and financial stability. Here is a true account from a customer of Country Financial found on Reddit. It tells of a real experience.

Comment

byu/Evangewhale from discussion

inQuadCities

Their feedback helps us understand how Allstate performs in terms of customer service, reliability, and the value of their insurance products.

Read More: How to Navigate the Home Insurance Claims Process

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

State Farm General Insurance Company Pros & Cons

Pros

- Comprehensive Coverage: State Farm provides a robust range of property and liability coverage options, including coverage for additional living expenses if your home becomes uninhabitable.

- Discounts for Bundling: Bundling your homeowners insurance with other policies, like auto insurance, is a big savings with State Farm.

- Wide Availability: State Farm Insurance offers coverage in nearly every state, making it a convenient choice for homeowners nationwide.

Cons

- Higher Premiums: State Farm is a popular insurance choice, but it might be pricier than smaller companies like Country Financial, especially if you’re in a high-risk area.

- More Customer Complaints: Despite high ratings, State Farm complaints are higher than other providers, particularly about claims and premium increases.

Country Casualty Insurance Company Pros & Cons

Pros

- Personalized Customer Service: Country Financial provides friendly, one-on-one help and guidance during the claims process.

- Competitive Pricing: If you want to find a budget-friendly option in homeowners insurance, Country Financial often has lower premiums than larger providers.

- Strong Financial Stability: The company has a great reputation for financial strength, which assures reliability in the case of claims and long term policyholder support.

Cons

- Limited Availability: According to Country Financial home insurance reviews, they’re primarily in the Midwest, so they likely won’t work for homeowners in other parts of the U.S.

- Claims Process Can Be Slower: While claims adjusters work hard to resolve issues, Country Financial’s claims process can sometimes be slower compared to the more streamlined systems at State Farm.

Making the Call: State Farm vs. Country Financial Homeowners Insurance

What does your home insurance coverage do for you? Home insurance coverage provides essential protection for your home and belongings, safeguarding against events like fire, theft, or severe weather. It also offers liability coverage if accidents occur on your property.

With extensive coverage options, strong customer support, and a much larger market presence, State Farm General Insurance Company is one of the top homeowners’ insurers. However, those premiums come at a price, and it sometimes receives customer complaints. While State Farm offers comprehensive protection, it’s important to assess whether the cost and customer service align with your needs.

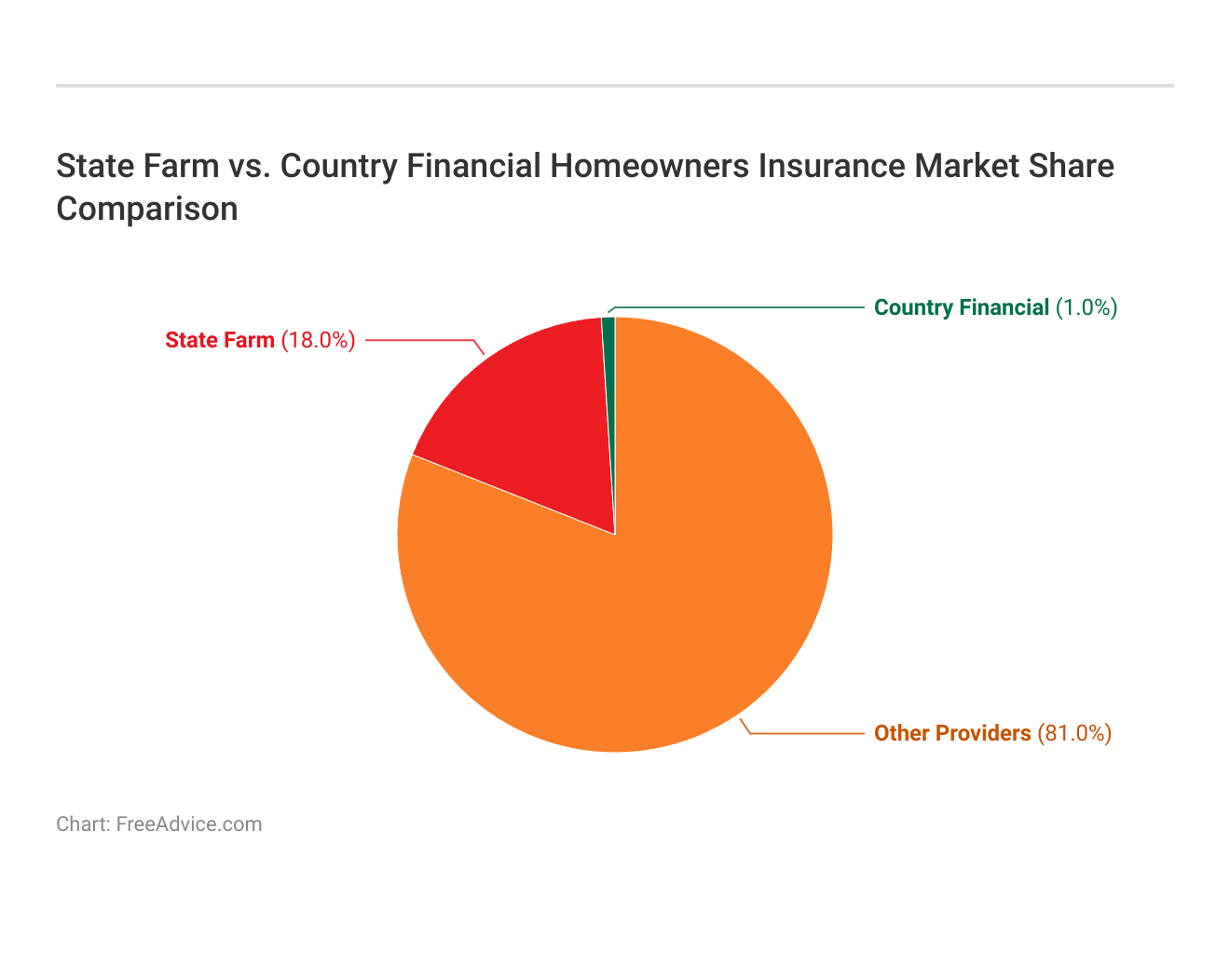

In contrast, Country Preferred Insurance Company provides personalized service and solid financial strength but has a smaller market share and fewer digital tools. Since State Farm has a solid 18% of the market while Country Financial sits at just 1%, it really comes down to whether you prefer a wider range of options and convenience or a more personalized, stable provider.

Finding affordable premiums for home insurance is easy with our free quote comparison tool. Just enter your ZIP code below to find cheap coverage for your home.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What insurance company has the best homeowners insurance?

The best homeowners insurance company can vary based on your location, coverage needs, and budget. However, State Farm is often recognized for its comprehensive coverage, strong customer service, and extensive discount options. Country Financial is also highly rated for its personalized service and financial stability, making it a competitive choice.

Who is State Farm Insurance’s biggest competitor?

State Farm’s biggest competitors include major national insurance providers such as Allstate, Geico, and Progressive. These companies offer similar homeowners insurance products and have a large market presence, making them strong competitors regarding coverage options and customer service.

Read More: Allstate Insurance Review

Who is the largest homeowner insurance company?

As mentioned in our State Farm home insurance reviews, it is currently the largest homeowner insurance company in the United States, holding approximately 18% of the market share. This market dominance is due to their extensive range of coverage options, robust financial stability, and strong brand reputation.

Find the cheapest home insurance today by entering your ZIP code below into our free comparison tool.

What insurance company has the most complaints in the USA?

According to data from the National Association of Insurance Commissioners (NAIC), certain large insurance companies, such as Allstate and Liberty Mutual, tend to receive higher volumes of complaints compared to smaller or more specialized providers. It’s essential to review complaint ratios and customer reviews before choosing a provider.

Read More: 10 Worst Insurance Companies in America

Who is the most expensive homeowners insurance?

Premiums for homeowners insurance can vary widely based on factors like location, coverage limits, and risk assessments. However, providers like Allstate and Nationwide are often reported to have higher average premiums than other major insurers. Always compare quotes tailored to your specific needs to determine the cost for your situation.

Which insurance company is best at paying claims?

USAA consistently ranks as one of the best insurance companies for paying claims promptly and fairly. While it serves primarily military members and their families, it is renowned for its exceptional claims service. State Farm also receives high marks for claim satisfaction due to its efficient claims processing and customer service.

What is Country Financial’s A.M. Best rating?

Mentioned in many Country Financial reviews they hold an A+ (Superior) rating from A.M. Best, indicating strong financial stability and the ability to meet ongoing insurance obligations. This high rating reflects the company’s reliability in covering claims and maintaining solid financial health.

Which homeowners insurance has the highest customer satisfaction rating?

According to J.D. Power’s annual home insurance study, USAA frequently holds the highest customer satisfaction rating, though it is only available to military members and their families. Among providers accessible to the general public, Amica Mutual and State Farm often receive top scores for customer satisfaction.

Which insurance company denies most claims?

While public data on claim denials can be difficult to pinpoint, some reports indicate that larger insurers like Allstate and Liberty Mutual may face criticism for higher claim denial rates. It’s crucial to know what to do when your home insurance claim is denied to get the settlement you deserve.

Which insurance company is best for claim settlement?

USAA is widely regarded as one of the best for claim settlement due to its customer-first approach and efficient processing. State Farm also excels in this area, with a reputation for straightforward claim handling and quick resolution times. Both are known for transparency and fair assessments.

Protecting your home doesn’t have to be expensive. Enter your ZIP code below into our free tool to find affordable homeowners insurance today.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.