State Farm vs. New York Life Insurance in 2024 (Side-by-Side Review)

State Farm vs. New York Life Insurance offers excellent coverage and pricing. State Farm provides affordable premiums starting at $30 monthly, while New York Life begins at $34. Both excel in life insurance options, with State Farm known for affordability and New York Life for its wide range of choices.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Dec 16, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Dec 16, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

When comparing State Farm vs. New York Life insurance, State Farm is the top choice due to its affordable $30 monthly premiums, lower than New York Life’s. State Farm’s reputation for offering cost-effective premiums and comprehensive coverage is reassuring for those on a tight budget.

Additionally, filing life insurance claims with State Farm Insurance is known to be straightforward, which adds convenience for policyholders. On the other hand, New York Life stands out for its diverse policy options and solid financial stability, making it an attractive choice for those seeking long-term reliability.

State Farm vs. New York Life Insurance Rating| Rating Criteria |  |

|

|---|---|---|

| Overall Score | 4.3 | 4.4 |

| Business Reviews | 5.0 | 5.0 |

| Claim Processing | 4.3 | 4.8 |

| Company Reputation | 4.5 | 4.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.2 | 4.6 |

| Customer Satisfaction | 4.1 | 4.1 |

| Digital Experience | 4.5 | 3.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.9 | 4.2 |

| Plan Personalization | 4.5 | 3.5 |

| Policy Options | 3.8 | 4.4 |

| Savings Potential | 4.3 | 4.5 |

| State Farm Review | New York Life Review |

By entering your ZIP code into our tool, you can get free quotes for life insurance and secure financial protection for your loved ones.

- State Farm offers the most budget-friendly rates, starting at just $30 monthly

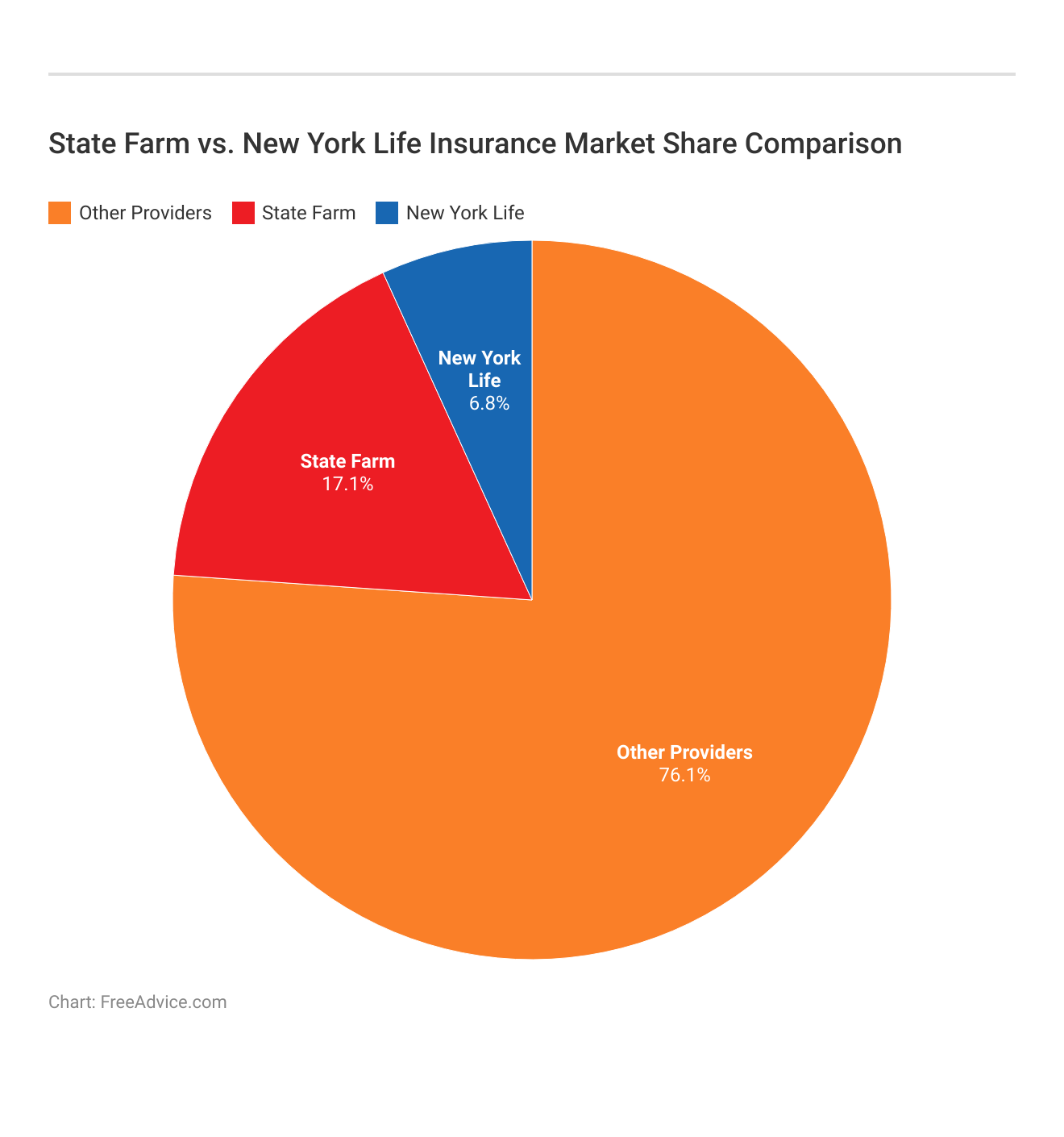

- New York Life is a strong contender in the life insurance market

- State Farm and New York Life offer the lowest competitive rates

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Life Insurance Coverage and Costs Comparison: State Farm vs. New York Life

State Farm is known for full, affordable life insurance, with about $30 monthly primary coverage. It may be better; it will balance its affordability and provisions of coverage options.

State Farm vs. New York Life Minimum Coverage Life Insurance Monthly Rates by Age & Gender

Age & Gender

Age: 18 Female $101 $110

Age: 18 Male $125 $135

Age: 25 Female $39 $45

Age: 25 Male $42 $48

Age: 45 Female $35 $40

Age: 45 Male $33 $37

Age: 60 Female $32 $36

Age: 60 Male $30 $34

In addition, State Farm offers various policy bundles, allowing clients to benefit from its affordable life insurance alongside other coverage options. Bundling these policies can be cost-effective for those seeking comprehensive financial security.

State Farm vs New York Life Minimum Coverage Auto Insurance Monthly Rates by Driving Record| Driving Record |  |

|

|---|---|---|

| Clean Record | $33 | $37 |

| Not-At-Fault Accident | $38 | $42 |

| Speeding Ticket | $40 | $46 |

| Reckless Driving | $50 | $58 |

| DUI/DWI | $45 | $53 |

New York Life, a company primarily focused on life insurance, offers a monthly premium of $34, slightly higher than State Farm’s.

However, the premium may vary depending on the policy and coverage options, and changing life insurance policy after purchase with New York Life is known to be flexible, allowing policyholders to adapt their coverage to evolving needs.

Life Insurance Coverage Options: State Farm vs. New York Life

State Farm offers term, whole, and universal life insurance. The most popular whole-life policy provides lifelong protection with a guaranteed cash value. Still, depending on the policyholder’s age and health, premiums for this policy can start at around $30 a month and go as high as $101 a month.

The hallmark of State Farm’s whole life insurance is flexibility in payment options. It is competitive for those who want control over the premium to ensure stable cash value growth. New York Life specializes in life insurance, including term, whole, and universal policies.

Although New York Life’s entire life premiums are usually higher than State Farm’s whole life insurance quotations, its policies provide solid financial backing and other customizable riders under flexible terms, including group life insurance cover, which makes it a suitable option for businesses and organizations seeking to address different economic goals for their members or employees.

State Farm and New York Life Insurance Comparison

State Farm tends to be more favorable in cost comparisons, with its life insurance generally less expensive than New York Life’s options. However, New York Life’s higher premiums can be attributed to additional benefits, such as more significant cash value growth and a more comprehensive selection of customizable options.

While State Farm remains the more budget-conscious choice, New York Life Ins. Co. may be worth the extra cost for policyholders seeking more extensive financial planning options, including adding a rider to an existing life insurance policy to enhance or customize their coverage based on specific needs.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Available Discounts for State Farm and New York Life Insurance

State Farm insurance company offers several discounts, including savings for bundling multiple policies like life and home insurance. Customers can also earn discounts for being long-term policyholders or purchasing additional coverage options, helping make life insurance more affordable.

Brandon Frady Licensed Insurance Agent

New York Life Insurance Company offers comparatively fewer discounts than State Farm. However, it provides incentives for long-term policyholders and for purchasing multiple policies.

While New York Life car insurance partners offer limited bundling discounts, its life insurance policies include savings for paying premiums annually and adding riders.

Customer Reviews and Business Ratings: State Farm vs. New York Life Insurance

People commend State Farm for its reliable customer service and comprehensive life insurance coverage options. Most clients appreciate the affordability of its life insurance policies. However, there are occasional delays in processing more complex claims.

Insurance Business Ratings & Consumer Reviews: State Farm vs. New York Life| Agency |  |

|

|---|---|---|

| Score: 877 / 1,000 Above Avg. Satisfaction | Score: 877 / 1,000 Above Avg. Satisfaction |

|

| Score: C- Below Avg. Business Practices | Score: A- Good Business Practices |

|

| Score: 75/100 Positive Customer Feedback | Score: 68/100 Avg. Customer Feedback |

|

| Score: 0.78 More Complaints Than Avg. | Score: 1.93 More Complaints Than Avg. |

|

| Score: B Fair Financial Strength | Score: A++ Superior Financial Strength |

Meanwhile, New York Life reviews are also positive, mainly the financial strength and stability of the company. Consumers like the flexibility in riders and the ability to customize, provided with a life insurance policy.

However, a few customers have commented that the premiums should be lowered, especially compared to what State Farm offers for whole-life insurance.

State Farm Pros and Cons

State Farm insurance agency is one of the most recognized insurance companies offering various life insurance options with competitive prices across different states. However, like other insurers, it has its strengths and weaknesses. Here’s a look at the pros and cons of State Farm:

Pros

- Bundle Deals are Most Affordable: State Farm’s whole life insurance is the most affordable when bundled up with State Farm Mutual automobile insurance.

- Extensive Coverage Choices: Various types of life insurance, such as term, whole, and universal life, provide flexibility in coverage.

- Several Discounts: A package discount for multiple policies, a discount for good driving, and long-time customer discounts help reduce overall insurance costs.

Cons

- Pricing More Expensive as the Customer Ages: State Farm’s whole life insurance is generally more expensive when the policy applicant ages.

- Limited Customization: Fewer rider options compared to competitors like NY Life insurance, reducing policy flexibility.

State Farm is a reliable life and auto insurance choice, offering various coverage options and affordable bundling discounts. However, there are a few drawbacks to consider.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

New York Life Pros and Cons

New York Life is a leading life insurance provider known for its financial strength and comprehensive range of life insurance products. Despite its benefits, there are some drawbacks to consider. Here’s an overview of New York Life’s pros and cons:

Pros

- Financial Stability: Offers solid financial backing, ensuring long-term reliability for policyholders.

- Higher Cash Value Growth: Whole life policies have higher cash value growth than State Farm’s whole life insurance.

- Customized Riders: Different types of riders enable clients to customize their life insurance policies to their needs.

Cons

- Higher Premiums: Comparing these two companies, NYL insurance is pricier than State Farm. This makes it less affordable to budget-conscious customers.

- Less Discounts: Offers fewer discounts, especially when bundling auto and life insurance through third-party partnerships.

New York Life stands out for its strong financial stability and customizable life insurance policies. Despite these benefits, higher premiums and fewer discounts may concern some customers. Uncover more by delving into our article, “What is a Life Insurance Beneficiary?“

Summary of State Farm vs. New York Life Insurance: Key Takeaways

In comparing State Farm vs. New York Life Insurance, State Farm stands out with affordable premiums, particularly for customers seeking budget-friendly life insurance.

Jeffrey Manola Licensed Insurance Agent

State Farm’s low-cost life coverage helps those looking to stay within financial limits. In contrast, New York Life offers more robust life insurance policies with higher cash value growth and greater flexibility, though at a higher price. State Farm would be better if you want a budget-friendly option with solid coverage.

However, even at higher premium rates, customers who wish for comprehensive life insurance with long-term benefits and customizable features still prefer New York Life. For additional insights, refer to our “Is Your Group Life Insurance Plan Right for You?” If you need life insurance coverage, use our free tool to enter your ZIP code and save time and money.

Frequently Asked Questions

What makes State Farm life insurance a good choice?

State Farm offers affordable premiums, making it an excellent option for those seeking budget-friendly life insurance with reliable coverage.

Gain deeper insights by pursuing our article, “The Insurable Interest in a Life Insurance Policy.”

How does New York Life differ from State Farm?

New York Life provides more robust policies with higher cash value growth and greater flexibility, though it comes at a higher cost than State Farm.

Which life insurance company offers the most affordable premiums?

State Farm offers lower premiums, making it a better choice for individuals on a budget.

Is New York Life worth the higher cost?

Yes, New York Life may justify the higher premium for those seeking higher cash value growth and more flexible policy options.

Dive into the details with our article, “How do I know if a specific life insurance rider aligns with my long-term financial goals?“

What are the main benefits of State Farm life insurance?

State Farm is known for affordable premiums, vital customer service, and a wide range of policies suitable for budget-conscious buyers.

What type of life insurance policies does New York Life offer?

New York Life offers more comprehensive policies focusing more on cash value accumulation and policy customization, which is ideal for long-term financial growth.

Free instant life insurance quotes are just a click away. Enter your ZIP code to get started.

Can I expect good cash value growth with State Farm?

While State Farm offers affordable premiums, its policies typically provide slower cash value growth than New York Life’s.

Explore our article titled “Best Life Insurance Policies for Ontrac Drivers.”

How flexible is New York Life’s life insurance?

New York Life offers highly flexible options, including the ability to customize policies and increase coverage as your needs change.

Which company should I choose for life insurance if I’m on a budget?

State Farm is the better choice if you’re looking for affordable life insurance that meets your basic coverage needs.

Does New York Life have more policy options than State Farm?

Yes, New York Life provides a broader range of policy types and customization options, catering to individuals seeking more robust coverage and long-term financial planning.

Delve into the specifics in our article, “Why does the government regulate life insurance companies?“

How does State Farm compare to MetLife for life insurance?

State Farm is known for its affordable premiums and straightforward policies, while MetLife stands out for offering group life insurance and a broader range of employee benefits. Choosing between the two depends on whether you need personal or workplace-focused coverage.

Does State Farm offer whole life insurance?

State Farm offers whole life insurance, lifetime coverage with fixed premiums, a guaranteed death benefit, and cash value accumulation.

What are the differences between State Farm and Nationwide life insurance?

State Farm offers competitive rates and simple life insurance options, while Nationwide excels in customization and additional riders like long-term care benefits. Nationwide may be better for those seeking more flexibility in their policy.

For a comprehensive understanding, consult our article “AARP (New York Life) Life Insurance Review.”

Is State Farm life insurance better than New York Life?

State Farm is often budget-friendly, while New York Life offers diverse policies and strong financial stability. New York Life is ideal for prioritizing long-term financial security and policy customization.

How does MetLife compare to New York Life for life insurance?

MetLife specializes in employer group life insurance, whereas New York Life provides various individual policies, focusing on financial planning and investment options.

Which is better for life insurance: Transamerica or New York Life?

Transamerica is known for competitive term policies and online tools, while New York Life offers more traditional whole-life and permanent insurance options with robust financial backing.

Enhance your knowledge by reading us, “Is life insurance considered an asset?“

How does MassMutual compare to New York Life?

Both are highly reputable, but MassMutual emphasizes dividend-paying policies, while New York Life provides exceptional financial stability and a range of customizable coverage options.

Looking for lower life insurance rates? Enter your ZIP code into our free quote comparison tool today and find the cheapest providers near you.

What are the key differences between New York Life and Northwestern Mutual?

Both companies are top-rated, but New York Life is known for its flexible policies and long-term reliability. At the same time, Northwestern Mutual is recognized for its robust financial planning services and dividend-paying policies.

How does Prudential compare to New York Life for life insurance?

Prudential is known for affordable term life options and digital tools, while New York Life focuses on permanent life insurance and financial stability. New York Life may be better for those seeking lifelong coverage.

Expand your understanding with our article called “Life Insurance for Unmarried Couples.”

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.