USAA vs. Hippo Homeowners Insurance in 2024 (Who Wins?)

Compare USAA vs. Hippo homeowners insurance's coverage, costs, and discounts. Hippo's rates start at $60/mo, while USAA's premiums begin at $58/mo. Hippo excels in tech-driven solutions, while USAA specializes in military-focused coverage. Both companies maintain strong customer satisfaction ratings.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

UPDATED: Dec 3, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Dec 3, 2024

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

0 reviews

0 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

0 reviews

0 reviewsThis extensive comparison of USAA vs. Hippo homeowners insurance review shows each company’s coverage, discounts, and costs, which start at just $60 a month for Hippo and $58 per month for USAA.

This guide breaks down discounts and customer service, helping you determine which insurer aligns with your needs. We’ll also address common questions like “How much homeowner insurance coverage do I need?”

USAA vs. Hippo Homeowners Insurance Rating| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.8 | 4.0 |

| Business Reviews | 4.5 | 4.0 |

| Claim Processing | 5.0 | 4.0 |

| Company Reputation | 5.0 | 4.5 |

| Coverage Availability | 5.0 | 4.1 |

| Coverage Value | 4.7 | 3.8 |

| Customer Satisfaction | 4.7 | 3.9 |

| Digital Experience | 5.0 | 4.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.6 | 3.9 |

| Plan Personalization | 5.0 | 4.0 |

| Policy Options | 4.7 | 3.5 |

| Savings Potential | 4.7 | 4.3 |

| USAA Review | Hippo Review |

Explore USAA vs. Hippo rates and coverage options to help you make an informed choice. Make sure to compare home insurance rates by entering your ZIP code to avoid overpaying.

- USAA and Hippo offer insurance starting at $108 per month

- Hippo homeowners insurance covers art and jewelry

- USAA offers earthquake and flood insurance

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Understanding Homeowners Insurance Coverage With Hippo & USAA

Homeowners insurance is a contract where you pay a premium for coverage against risks like damage to your home, belongings, and liability for injuries or property damage.

Brandon Frady LICENSED INSURANCE AGENT

USAA and Hippo both include dwelling coverage for the structure of your home and attached features like garages or decks, personal property coverage for your belongings both inside and outside the home, and liability protection in case of lawsuits.

About United Services Automobile Association

Founded in 1922, USAA has become one of the most trusted insurers in the U.S., known for its exceptional customer service and reliability, particularly among military families. Offering a range of insurance products, including homeowners, auto, and life insurance, USAA makes it easy to bundle policies for added convenience.

The true uniqueness of USAA is in making sure it serves the military community, with solutions tailored to the needs of active duty service members, veterans and their families.

About Hippo Insurance Services

Hippo Insurance, founded in 2015, is a tech-driven, customer-centric disruption of traditional homeowners insurance. Utilizing advanced analytics and smart home technology, Hippo provides homeowners with options for customizable coverage specific to their vulnerabilities, like where they live, the materials they built with, and any special features (pools, trampolines, etc.).

Read More: Hippo Homeowners Insurance Review

The company essentially simplifies the insurance process by offering a digital experience for managing policies online, with no paperwork process or phone calls required. Hippo provides 24/7 claims support and fast, efficient handling so you don’t have to deal with any hassle.

Comparing USAA and Hippo Homeowners Insurance

Now that we have looked at the individual overview of USAA and Hippo homeowners insurance it’s time to compare the two and see how they compare against each other.

The truth is that insurance premiums can vary on lots of factors, which includes location, house value, and personal circles. As a rule, USAA is known for affordable rates that are specially tailored to help military members.

USAA vs. Hippo Minimum Coverage Homeowners Insurance Monthly Rates by Age & Gender| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $255 | $510 |

| Age: 16 Male | $260 | $525 |

| Age: 30 Female | $75 | $85 |

| Age: 30 Male | $80 | $90 |

| Age: 45 Female | $68 | $70 |

| Age: 45 Male | $70 | $72 |

| Age: 60 Female | $58 | $60 |

| Age: 60 Male | $60 | $62 |

Ultimately, Hippo’s pricing may be determined by their use of smart home technology. The savings that can come from homeowners using these devices can be had at the expense of an initial investment in smart home equipment, but it’s important to evaluate the savings against the investment.

USAA vs. Hippo: Coverage Comparison

Both USAA and Hippo offer comprehensive coverage that includes dwelling coverage, personal property coverage, and liability coverage. However, USAA’s coverage is tailored specifically to military members and their families, while Hippo’s coverage is designed for a wider audience.

In terms of optional coverages, both providers offer additional protections, such as earthquake insurance and extended coverage for high-value items. However, Hippo’s use of smart home technology sets them apart by providing proactive loss prevention.

Coverage Options With USAA

And when it comes to protecting your home, USAA offers complete coverage that protects your property, your personal belongings against a range of risks. You can expect their policies to have dwelling coverage, personal property coverage and liability coverage.

- Dwelling Coverage: Protects the structure of your home (walls, roof, foundation) from risks like fire, vandalism, and severe weather.

- Personal Property Coverage: Helps repair or replace your belongings if damaged or stolen.

- Optional Coverages: USAA offers optional earthquake and flood insurance for added protection in high-risk areas.

- Add-Ons: USAA offers identity theft coverage to protect against fraud and home-sharing coverage for homeowners renting out property, such as on Airbnb.

With USAA’s comprehensive coverage, you can rest easy knowing your home and belongings are protected from life’s unexpected events.

Coverage Options With Hippo

Based on Hippo insurance reviews, they offer innovative homeowners insurance focusing on smart technology and customizable coverage to help protect your home and belongings.

- Standard & Optional Coverages: Hippo offers optional coverage for equipment breakdown, water backup, high-value items, and Hippo earthquake insurance.

- Smart Home Tech: Hippo provides free smart devices and alerts for potential risks like water leaks.

- Unique Approach: Hippo uses special technology in homes to help people avoid losing things. This helps keep their homes safe and manage problems before they happen.

Does Hippo homeowners insurance cover damage from hurricanes? Yes, Hippo homeowners insurance generally covers hurricane damage, including wind and water, though coverage details may vary by policy.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Business & Customer Service Ratings Comparison

Both USAA and Hippo are well known for their customer service. USAA is well known for having some of the very best customer support and a very easy claims process, and it gets high customer satisfaction ratings. But Hippo is unique because it delivers a digital-first, user-friendly experience. Homeowners find their intuitive online platform easy to use and will receive support when they need it.

Insurance Business Ratings & Consumer Reviews: USAA vs. Hippo| Agency | ||

|---|---|---|

| Score: 882 / 1,000 Above Avg. Satisfaction | Score: 882 / 1,000 Above Avg. Satisfaction |

|

| Score: A++ Excellent Business Practices | Score: A+ Great Business Practices |

|

| Score: 96/100 High Customer Satisfaction | Score: 80/100 Good Customer Feedback |

|

| Score: 1.74 More Complaints Than Avg. | Score: 1.75 More Complaints Than Avg. |

|

| Score: A++ Superior Financial Strength | Score: A- Good Financial Strength |

USAA and Hippo are both highly regarded for customer service, with each earning an 882 out of 1,000 from J.D. Power, indicating above-average satisfaction. USAA stands out for its strong financial stability, with an A++ rating from A.M. Best and high Consumer Reports ratings (96/100), while Hippo offers a tech-driven, user-friendly platform with an A rating for financial strength and a good (80/100) score on Consumer Reports.

YOU BOUGHT IT. IT’S TIME TO OWN IT.

We give your home a checkup and provide a complementary, personalized home health profile to identify and troubleshoot any issues. pic.twitter.com/wCVVaxjLCH

— Hippo (@hippo_insurance) August 30, 2022

Both insurers have above-average complaint rates, with scores of 1.74 for USAA and 1.75 for Hippo. Choosing between the two depends on your priorities: USAA is ideal for military families seeking personalized coverage, while Hippo appeals to those looking for innovative, digital-first solutions.

Read More: Worst Insurance Companies in America According to AAJ

USAA and Hippo Home Insurance Review

So when comparing USAA and Hippo homeowners insurance, it’s not enough to just see what they’re claiming — you need to also compare what people who’ve bought it are saying. Check this Reddit post about USAA home insurance review.

Comment

byu/nicklepimple from discussion

inVeterans

USAA’s rates aren’t the lowest, but its reliability when it comes to handling claims and consistent customer service shows its market share is larger than newer competitors like Hippo.

Insurance Discounts Between USAA and Hippo

USAA and Hippo both offer valuable homeowners insurance discounts, though with different focuses. USAA provides discounts for bundling policies, installing protective devices, having a claims-free history, and offering special rates for military members. Stop overpaying for auto and home insurance by bundling insurance with USAA to take advantage of these savings

Hippo emphasizes tech-driven savings, such as for smart home devices and home upgrades, and also offers discounts for bundling, claims-free records, and newer homes. While USAA has a broader range of traditional discounts, Hippo targets digital-savvy homeowners with its modern, tech-oriented approach.

Pros and Cons of USAA Homeowners Insurance

Pros

- Tailored Coverage: As mentioned in our USAA homeowners insurance review page, custom coverage is available for military members on or off base.

- Efficient Claims Process: With prompt support, claims processing at USAA is fast and hassle-free.

- Exclusively for the Military Community: USAA tailors all coverage to protect service members on and off base.

Cons

- Limited Accessibility: Service is restricted to USAA-eligible military members and their families.

- Potentially Higher Rates: Some areas face higher premium rates with USAA than competitors.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of Hippo Insurance

Pros

- Tech-Driven Prevention: Hippo’s smart device system helps prevent damage before it occurs

- Customizable Coverage: Does Hippo homeowners insurance cover jewelry? They have flexible policies for high-value items such as art and jewelry.

- Convenient Digital Experience: Tech-savvy homeowners can manage their Hippo policies entirely online.

Cons

- Limited Availability: Hippo’s coverage isn’t yet available in all states across the U.S.

- Digital-Only Service: Customer support from Hippo is digital-only, lacking in-person service options.

USAA vs. Hippo Homeowners Insurance: Choosing the Right One

USAA and Hippo both have strong homeowners insurance, but they differ in what they do well. If you’re a military family, USAA is an excellent option because it offers personalized coverage at competitive rates, but it misses some of the most modern tech features.

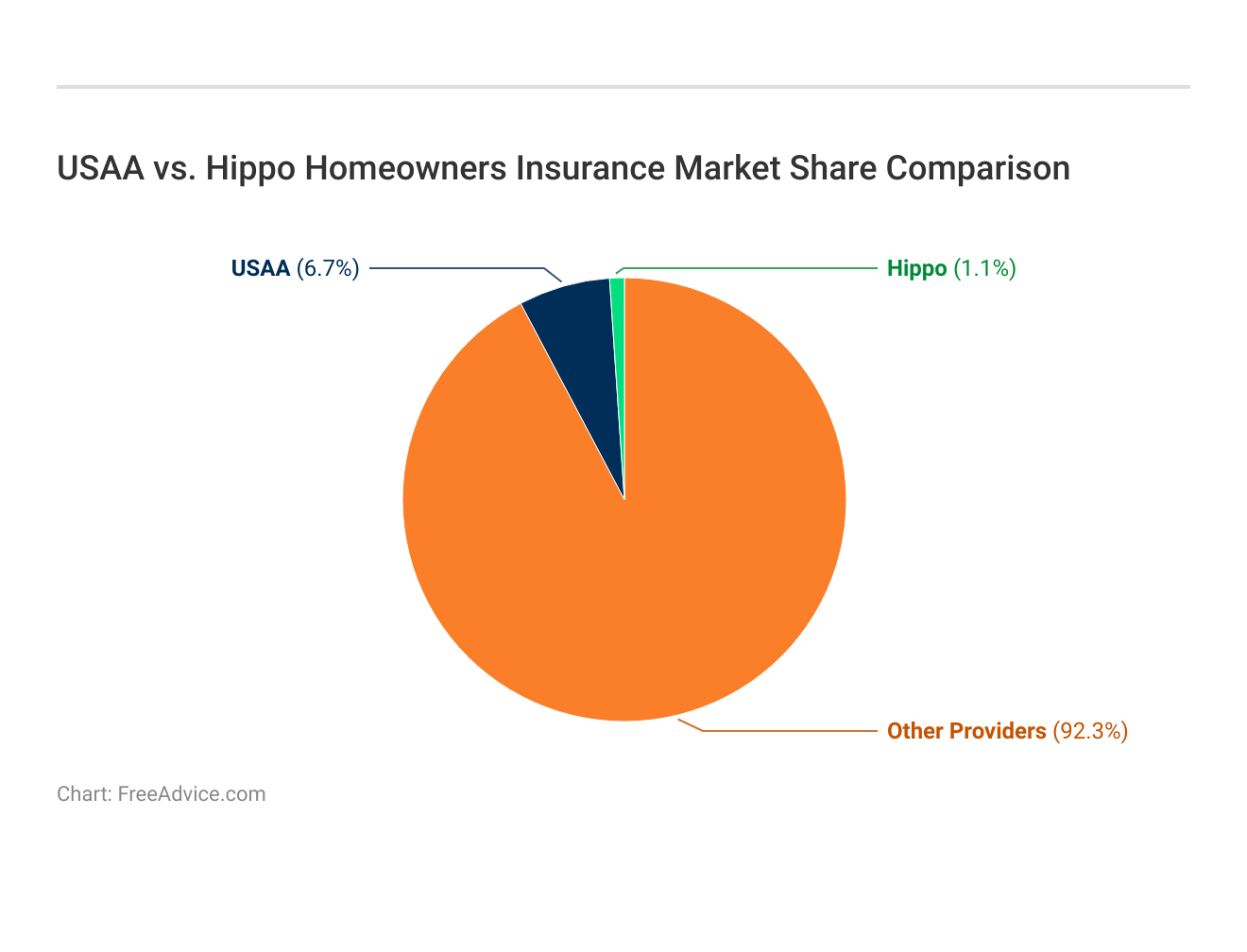

Hippo, however, stands out with smart home technology, personalized coverage, and a smooth digital experience, but its digital-first approach may not be the right fit for those who prefer in-person service. USAA has 6.7%, Hippo has 1.1%, and other providers have 92.3% of the market share.

Ultimately, it depends on your personal preferences and coverage needs. Get home insurance quotes online, and find a winning home insurance policy that best fits your lifestyle—whether you’re looking for military-focused coverage with USAA or a modern, tech-driven experience with Hippo.

Make sure your home is protected by entering your ZIP code into our home insurance comparison tool today.

Frequently Asked Questions

Is Hippo insurance legitimate?

Yes, Hippo Insurance is legitimate, offering tech-driven, customizable coverage with an A financial strength rating and innovative solutions for homeowners. See how Hippo Insurance compares to its competitors to determine if it’s the right fit for your needs.

Who is USAA’s biggest competitor?

USAA’s biggest competitors include major insurers like State Farm, Geico, and Allstate, offering broad coverage and competitive rates.

Read More: Geico Auto Insurance Review

Does USAA have the best home insurance rates?

USAA offers competitive rates for military families, but comparing quotes is essential to find the best deal for your needs. Don’t settle for expensive home insurance premiums. Enter your ZIP code to find robust coverage for your dwelling at an affordable price.

Does Hippo insurance pay claims?

Yes, Hippo Insurance efficiently handles claims through its 24/7 digital-first claims process, ensuring fast and reliable service.

Can anyone get USAA insurance?

No, USAA insurance is exclusive to military members, veterans, and their families, offering specialized coverage for this group.

What are the disadvantages of USAA?

USAA is limited to military families and may not always have the lowest rates in certain areas.

Read More: Military Car Insurance Discounts and Tips

Which insurance company is best for home insurance?

The best choice depends on your needs, with USAA ideal for military families and Hippo excelling in tech-driven, customizable coverage.

Is Hippo reliable?

Yes, Hippo is reliable, offering strong financial backing, efficient claims processing, and proactive risk prevention through smart home technology.

Read More: Bundling Home and Auto Insurance With Hippo

Who is behind Hippo Insurance?

Hippo Insurance was founded in 2015 by Assaf Wand and Eyal Navon, with backing from leading venture capital firms.

What is the financial rating of Hippo?

Hippo holds an A financial strength rating, reflecting its stability and ability to handle claims effectively.

Does USAA homeowners insurance cover foundation repairs?

USAA may cover foundation repairs if caused by covered perils like water leaks or floods. However, weather-related coverage exclusions may apply depending on the policy.

Does USAA provide water leak detection coverage?

USAA policies often include water leak detection tools or services to prevent costly damage, enhance overall property protection, and offer robust types of homeowners insurance.

Does USAA offer pool insurance?

Yes, USAA offers pool insurance as part of their homeowner’s policies, protecting against liability and damage related to pool ownership. Protecting your home doesn’t have to be expensive. Enter your ZIP code into our free tool to find affordable homeowners insurance today.

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.